Since its large-scale launch in 2020, Huimin Insurance has become an important part of the multi-level medical insurance system.

By the end of 2022, Huimin Insurance had listed a total of 408 products (products from the same city in different years are counted as different products), covering 29 provinces, autonomous regions and municipalities directly under the Central Government, totaling 150 cities. The cumulative number of insured persons has reached 280 million (the number of times the same insured person applied for the same product in different years is counted cumulatively), with a cumulative premium income of about 30.7 billion yuan.

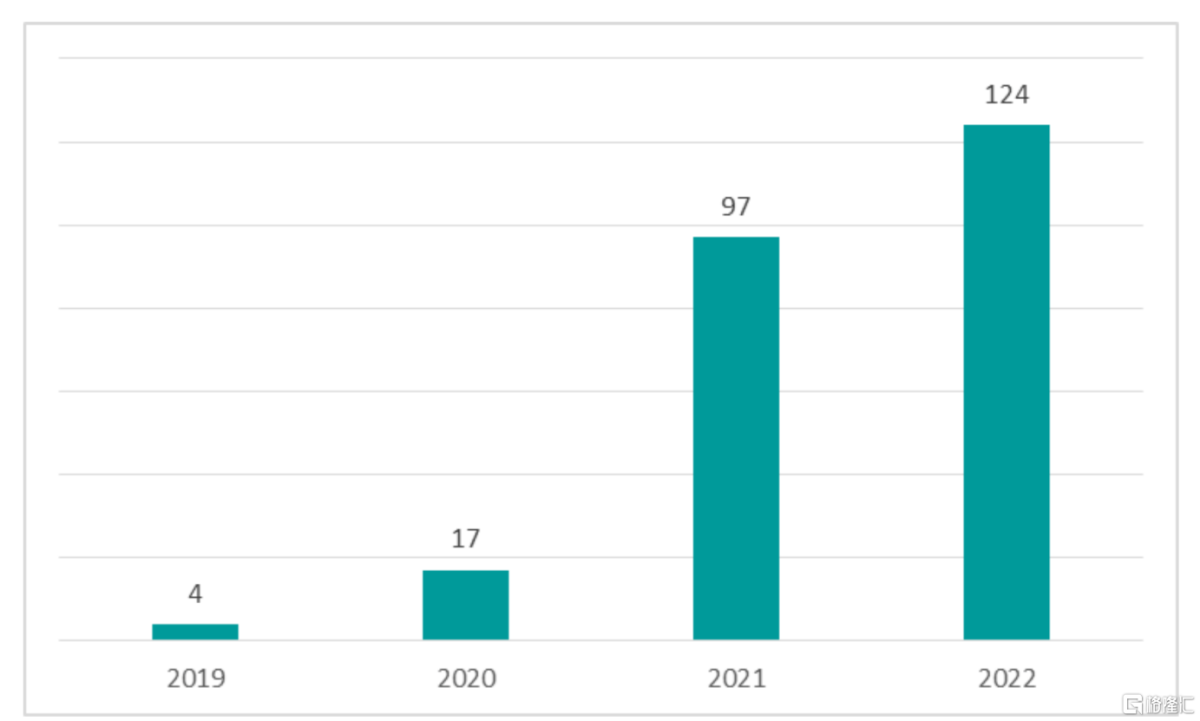

Figure 1: The size of Huimin insurance premiums in 2019-2022 (unit: 100 million yuan)

(Source: China Life Insurance)

Obviously, Huimin Insurance has become an important force that cannot be ignored by the insurance industry.

However, due to the special nature of Huimin Insurance products, many of the participants themselves do not fully understand the essence and content of Huimin Insurance products. More because they have the credit of the local government as an endorsement of Huimin Insurance, they directly participate in insurance applications and lack a correct understanding of Huimin Insurance products. This is not conducive to their long-term sustainable development.

Recently, Zhongzai Life Insurance, a subsidiary of China CZai Group, released the “Connotation, Status and Sustainable Development of Huimin Insurance” report, which systematically sorts out and summarizes the practical experience and research results of China's “one city, one policy” in promoting welfare insurance in the past two years, with a view to exploring the path of high-quality development of Huimin Insurance on the basis of summing up experiences and sorting out issues. After watching the press conference of this report and the live broadcast of the forum, I had some new feelings about Huimin Insurance. I could also take this opportunity to discuss my understanding of Huimin Insurance and the Sino Rei Group industry perception.

1. The principle of social equity

Welfare insurance, or “urban customized commercial medical insurance”, is guided by local governments and relevant departments, operated commercially by insurance companies, and linked to basic health insurance. In the blueprint plan for a multi-level medical insurance system with basic medical insurance as the main body and medical aid as the backbone to supplement medical insurance, commercial health insurance, charitable donations, and mutual medical assistance, Huimin Insurance is part of the supplementary health insurance and is the key to connecting basic medical insurance with commercial health insurance.

The inclusive insurance attributes of Huimin Insurance are particularly prominent, allowing the public to participate widely in it. For this reason, Huimin Insurance allows sick people and the elderly to apply for insurance, and they pay the same premiums regardless of the physical condition or age of the insured person.

Obviously, this is different from the “actuarial fairness” of traditional commercial health insurance. Huimin Insurance emphasizes “social fairness”. Essentially, this is a subsidy for healthy people, young people, the sick, and the elderly. It provides affordable solutions for people difficult to cover by traditional commercial health insurance, effectively alleviates the burden of social health care. It is particularly important under the trend of China's aging population. It is an important part of China's construction of a multi-level health insurance system.

2. The participation rate remains stable

From this point of view, welfare protection requires a steady stream of young people and healthy bodies to maintain a dynamic balance.

However, under the “social equity” principle, the same premiums mean that the value that the elderly and sick people can get is far higher than that of young people and healthy bodies. Over time, the latter may withdraw in real life because they have not been rewarded. The proportion of people who are left behind in need of claims will rise. Insurance companies will inevitably raise premium levels in order to control costs, which in turn will encourage more healthy bodies and young people to withdraw. A “death spiral” may occur due to this, and the survival crisis of welfare products will follow.

At present, the participation rate has remained stable. Overall, after excluding provincial projects, the average participation rate for Huimin Insurance in 2022 was 15.3%, which is basically the same as the average participation rate of 15.2% in 2021. However, since Huimin Insurance is concerned about catastrophic medical risks, its odds are low, usually less than 5%. Even if measures to reduce deductibles are used, the effect on improving odds is still limited, putting pressure on improving the efficiency of insurance enrolment. Enrolment efficiency refers to the number of insured persons within the same period of enrolment.

China Life Insurance believes that the risk that the efficiency of insurance enrolment will decline year by year is unavoidable. To mitigate this risk, the public can fully understand and agree with the intergenerational transfer mechanism of Huimin Insurance, or extend the Huimin Insurance positioning from a “major disaster risk guarantee” to a “health management aggregation platform” to retain young people and healthy bodies.

3. Clear boundaries between government and business mean better sustainability

As the degree of participation of government departments deepened and the attributes of public utilities benefiting people's insurance increased, commercial attributes weakened accordingly. Government agencies usually limit the minimum payout rate for Huimin Insurance to control the profit margins of commercial insurance companies.

Generally speaking, the minimum payout rate is currently usually set at 85%-90%, which means that insurance companies need to cover sales costs, operating costs, and risk costs of overpaying risk through a 10%-15% fee rate. “Low capital protection” will become the norm in business, but for insurance companies, the business momentum will seem insufficient.

Whether the boundary between the government and commercial insurance companies can be clearly and unequivocally delineated determines whether Huimin Insurance can achieve sustainable development. Ensuring that Huimin Insurance has strong commercial attributes and gives business entities full motivation to participate will help ease the problem of Huimin Insurance's sustainable development from another perspective.

4. China is also keenly aware of the development of the industry

China Rei Group has core competitiveness in data empowerment, product development, and industrial integration. China Regroup has deep data analysis and pricing capabilities; exports product plans to direct insurance companies and undertakes risks; targets industry integrators, aggregates resources, and transforms services into insurance products.

Since 2020, China has launched the welfare insurance business, actively served the healthy China strategy, participated in inclusive finance practices, promoted the implementation of welfare insurance projects nationwide through data, products and technical advantages, and provided major reinsurance support, and accumulated rich experience in empirical analysis and product iteration.

China's keen awareness of industry trends has been translated into increased business value. In 2022, China Regroup's personal reinsurance coverage business grew rapidly, and underwriting benefits improved significantly: premium income was 29.065 billion yuan, up 11.6% year on year; underwriting profit of short-term insurance business was 569 million yuan, up 37.1% year on year. This is particularly rare in a context where the entire life insurance industry has entered deep transformation and growth has stalled.

China is also making simultaneous efforts on the traditional track and the innovation track, seizing major business opportunities in the medical insurance market, actively seizing the transformation opportunities of the medical insurance market, maintaining a leading market share advantage, relying on industry integration to deeply participate in welfare services benefiting people in many regions, and relying on product innovation to seize potential market opportunities such as innovative cancer therapies and consumer medicine.

epilogue

As an innovative health insurance product, Huimin Insurance has had a substantial impact on the insurance market. It provides a new insurance solution for the elderly and the sick, allows people in need of protection to enjoy a higher level of protection from commercial medical insurance “without threshold” and “low burden”, helped the government improve the medical insurance system, and also brought new growth points to insurance companies. It is a new model that can achieve a win-win situation for all parties.

However, it is undeniable that due to the inherent “social fairness” connotation of benefiting the people and protecting the people, how to achieve sustainable development has become the most important issue in the future. This requires not only further improving product details and gaining public approval, but also clarifying the functions of government and business, so that market players can exert greater activism. As a channel for China's reinsurance owners, China can continue to promote the sustainable development of welfare insurance and achieve healthy interaction between the healthy development of the industry and the increase in its own value through its accumulated experience and technical advantages in commercial health insurance.