As an investor, mistakes are inevitable. But really bad investments should be rare. So spare a thought for the long term shareholders of Hope Education Group Co., Ltd. (HKG:1765); the share price is down a whopping 73% in the last three years. That'd be enough to cause even the strongest minds some disquiet. The falls have accelerated recently, with the share price down 15% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

While the last three years has been tough for Hope Education Group shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Hope Education Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

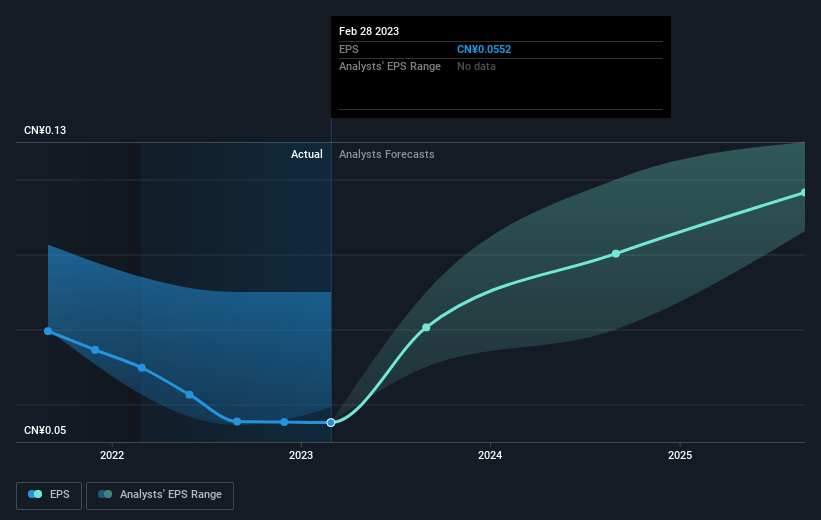

During the three years that the share price fell, Hope Education Group's earnings per share (EPS) dropped by 9.1% each year. This reduction in EPS is slower than the 35% annual reduction in the share price. So it seems the market was too confident about the business, in the past. This increased caution is also evident in the rather low P/E ratio, which is sitting at 9.92.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Hope Education Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Pleasingly, Hope Education Group's total shareholder return last year was 36%. What is absolutely clear is that is far preferable to the dismal 20% average annual loss suffered over the last three years. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Hope Education Group that you should be aware of before investing here.

Of course Hope Education Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.