The market wasn't impressed with the soft earnings from Jy Gas Limited (HKG:1407) recently. We did some further digging and think they have a few more reasons to be concerned beyond the statutory profit.

See our latest analysis for Jy Gas

Examining Cashflow Against Jy Gas' Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

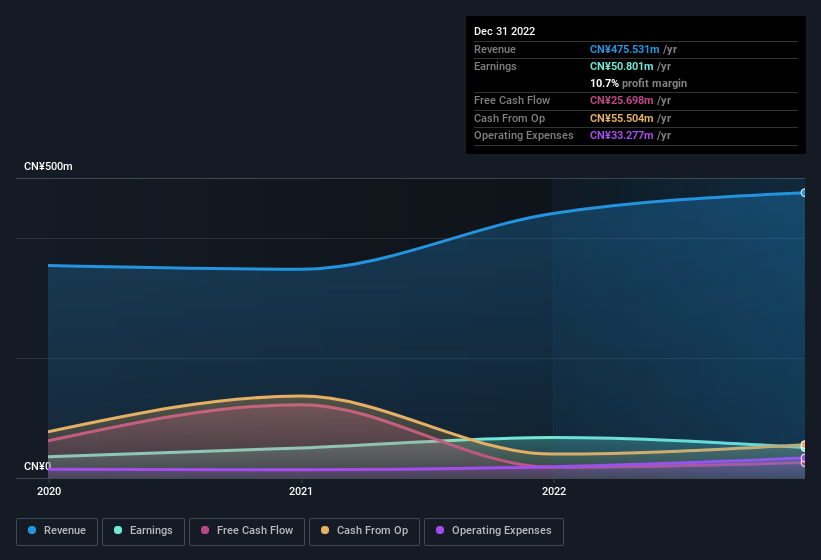

Jy Gas has an accrual ratio of 0.21 for the year to December 2022. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. To wit, it produced free cash flow of CN¥26m during the period, falling well short of its reported profit of CN¥50.8m. At this point we should mention that Jy Gas did manage to increase its free cash flow in the last twelve months

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Jy Gas.

Our Take On Jy Gas' Profit Performance

Jy Gas' accrual ratio for the last twelve months signifies cash conversion is less than ideal, which is a negative when it comes to our view of its earnings. Because of this, we think that it may be that Jy Gas' statutory profits are better than its underlying earnings power. In further bad news, its earnings per share decreased in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For instance, we've identified 4 warning signs for Jy Gas (1 is significant) you should be familiar with.

This note has only looked at a single factor that sheds light on the nature of Jy Gas' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.