Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by Meisheng Cultural & Creative Corp, Ltd. (SZSE:002699) shareholders over the last year, as the share price declined 48%. That's well below the market return of 6.5%. Even if you look out three years, the returns are still disappointing, with the share price down46% in that time. The last week also saw the share price slip down another 14%. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Meisheng Cultural & Creative Corp

Meisheng Cultural & Creative Corp wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Meisheng Cultural & Creative Corp increased its revenue by 22%. We think that is pretty nice growth. Meanwhile, the share price is down 48% over twelve months, which is disappointing given the progress made. You might even wonder if the share price was previously over-hyped. But if revenue keeps growing, then at a certain point the share price would likely follow.

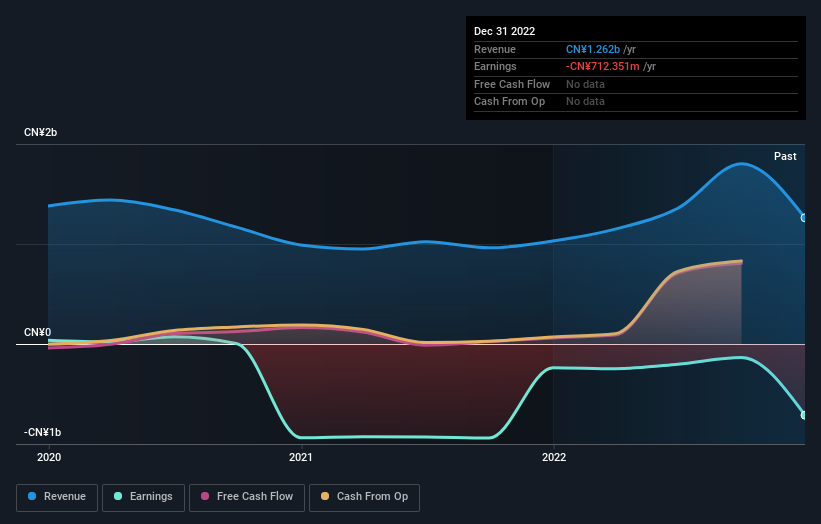

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Meisheng Cultural & Creative Corp's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Meisheng Cultural & Creative Corp shares, which cost holders 48%, while the market was up about 6.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 13% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand Meisheng Cultural & Creative Corp better, we need to consider many other factors. For instance, we've identified 1 warning sign for Meisheng Cultural & Creative Corp that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.