Asia Energy Logistics Group Limited (HKG:351) shares have had a really impressive month, gaining 52% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 43% over that time.

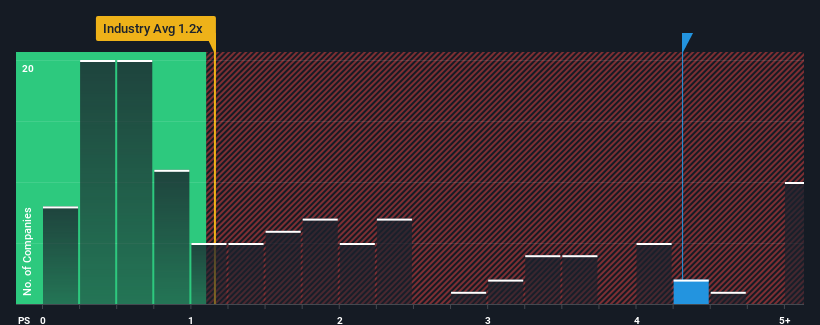

After such a large jump in price, you could be forgiven for thinking Asia Energy Logistics Group is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.3x, considering almost half the companies in Hong Kong's Shipping industry have P/S ratios below 0.7x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Asia Energy Logistics Group

How Has Asia Energy Logistics Group Performed Recently?

With revenue growth that's exceedingly strong of late, Asia Energy Logistics Group has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Asia Energy Logistics Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Asia Energy Logistics Group would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 65% gain to the company's top line. Pleasingly, revenue has also lifted 140% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 29% shows it's a great look while it lasts.

In light of this, it's understandable that Asia Energy Logistics Group's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

What We Can Learn From Asia Energy Logistics Group's P/S?

Asia Energy Logistics Group's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As detailed previously, the strength of Asia Energy Logistics Group's recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its revenue performance persists.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Asia Energy Logistics Group (1 is significant!) that you should be aware of before investing here.

If you're unsure about the strength of Asia Energy Logistics Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.