It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like MINISO Group Holding (NYSE:MNSO), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for MINISO Group Holding

MINISO Group Holding's Improving Profits

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So EPS growth can certainly encourage an investor to take note of a stock. MINISO Group Holding's EPS shot up from CN¥1.81 to CN¥2.84; a result that's bound to keep shareholders happy. That's a fantastic gain of 56%.

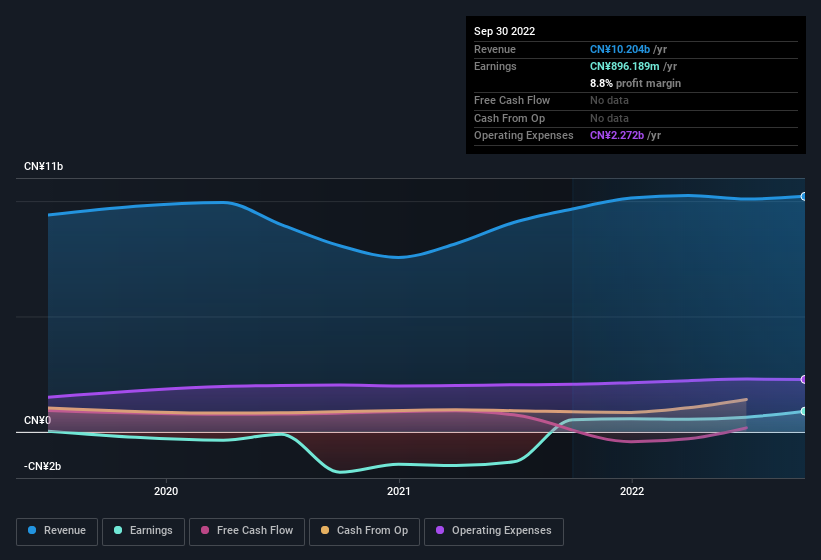

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of MINISO Group Holding shareholders is that EBIT margins have grown from 6.7% to 10% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for MINISO Group Holding?

Are MINISO Group Holding Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But more importantly, Founder Guofu Ye spent CN¥126k acquiring shares, doing so at an average price of CN¥5.25. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for MINISO Group Holding will reveal that insiders own a significant piece of the pie. Indeed, with a collective holding of 71%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling CN¥3.4b. That level of investment from insiders is nothing to sneeze at.

Should You Add MINISO Group Holding To Your Watchlist?

For growth investors, MINISO Group Holding's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. So it's fair to say that this stock may well deserve a spot on your watchlist. You still need to take note of risks, for example - MINISO Group Holding has 2 warning signs we think you should be aware of.

Keen growth investors love to see insider buying. Thankfully, MINISO Group Holding isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.