Most people feel a little frustrated if a stock they own goes down in price. But in the short term the market is a voting machine, and the share price movements may not reflect the underlying business performance. The Ningbo TIP Rubber Technology Co.,Ltd (SHSE:605255) is down 12% over a year, but the total shareholder return is -9.8% once you include the dividend. That's better than the market which declined 20% over the last year. Ningbo TIP Rubber TechnologyLtd hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. On top of that, the share price is down 18% in the last week.

After losing 18% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Ningbo TIP Rubber TechnologyLtd

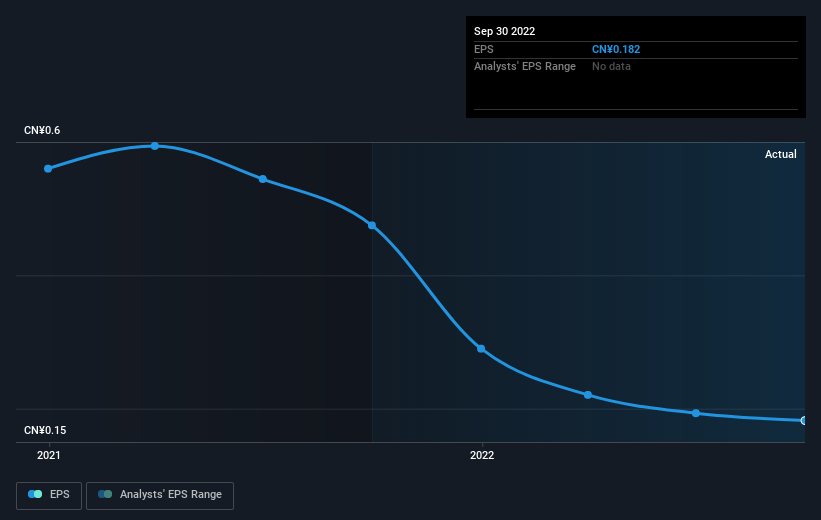

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, Ningbo TIP Rubber TechnologyLtd had to report a 62% decline in EPS over the last year. This fall in the EPS is significantly worse than the 12% the share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster. Indeed, with a P/E ratio of 80.04 there is obviously some real optimism that earnings will bounce back.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

SHSE:605255 Earnings Per Share Growth December 23rd 2022

SHSE:605255 Earnings Per Share Growth December 23rd 2022Dive deeper into Ningbo TIP Rubber TechnologyLtd's key metrics by checking this interactive graph of Ningbo TIP Rubber TechnologyLtd's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Ningbo TIP Rubber TechnologyLtd, it has a TSR of -9.8% for the last 1 year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While they no doubt would have preferred make a profit, at least Ningbo TIP Rubber TechnologyLtd shareholders didn't do too badly in the last year. Their loss of 9.8%, including dividends, actually beat the broader market, which lost around 20%. Things weren't so bad until the last three months, when the stock dropped 11%. It's always a worry to see a share price decline like that, but at the same time, it is an unavoidable part of investing. However, this could create an opportunity if the fundamentals remain strong. It's always interesting to track share price performance over the longer term. But to understand Ningbo TIP Rubber TechnologyLtd better, we need to consider many other factors. Even so, be aware that Ningbo TIP Rubber TechnologyLtd is showing 3 warning signs in our investment analysis , and 2 of those shouldn't be ignored...

But note: Ningbo TIP Rubber TechnologyLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.