Unless you borrow money to invest, the potential losses are limited. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Dashan Education Holdings Limited (HKG:9986) share price has soared 281% return in just a single year. Also pleasing for shareholders was the 212% gain in the last three months. Dashan Education Holdings hasn't been listed for long, so it's still not clear if it is a long term winner.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Dashan Education Holdings

Dashan Education Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Dashan Education Holdings actually shrunk its revenue over the last year, with a reduction of 67%. We're a little surprised to see the share price pop 281% in the last year. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

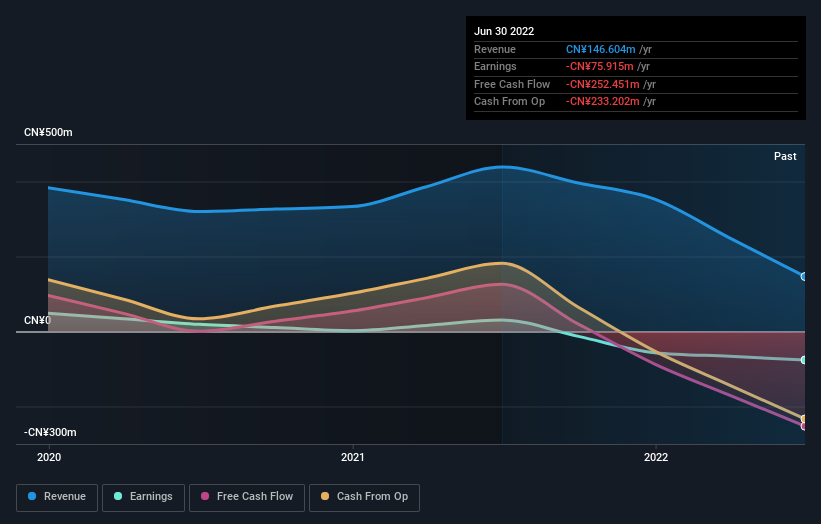

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

SEHK:9986 Earnings and Revenue Growth December 22nd 2022

SEHK:9986 Earnings and Revenue Growth December 22nd 2022Take a more thorough look at Dashan Education Holdings' financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Dashan Education Holdings shareholders have gained 281% over the last year. A substantial portion of that gain has come in the last three months, with the stock up 212% in that time. This suggests the company is continuing to win over new investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Dashan Education Holdings you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.