For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Shenzhen Hepalink Pharmaceutical Group Co., Ltd. (SZSE:002399) shareholders, since the share price is down 25% in the last three years, falling well short of the market return of around 23%. Furthermore, it's down 11% in about a quarter. That's not much fun for holders.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Shenzhen Hepalink Pharmaceutical Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

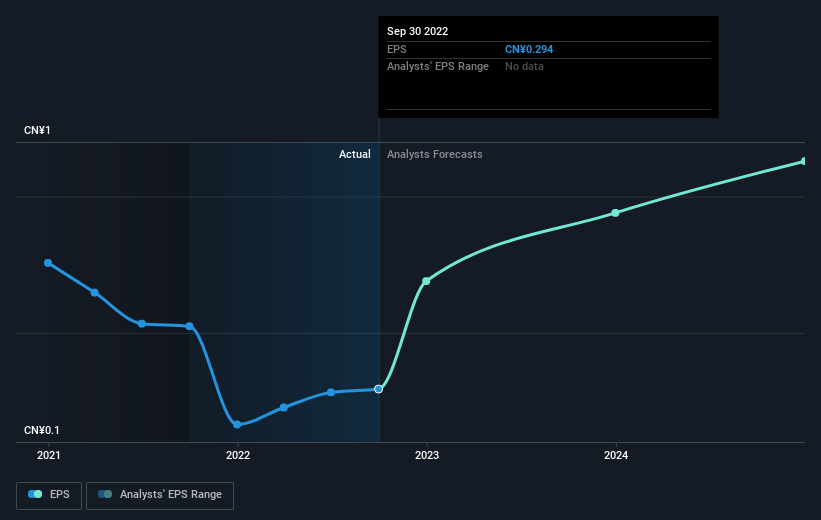

During the three years that the share price fell, Shenzhen Hepalink Pharmaceutical Group's earnings per share (EPS) dropped by 23% each year. This fall in the EPS is worse than the 9% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines. This positive sentiment is also reflected in the generous P/E ratio of 46.72.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

SZSE:002399 Earnings Per Share Growth December 15th 2022

SZSE:002399 Earnings Per Share Growth December 15th 2022Dive deeper into Shenzhen Hepalink Pharmaceutical Group's key metrics by checking this interactive graph of Shenzhen Hepalink Pharmaceutical Group's earnings, revenue and cash flow.

A Different Perspective

While it's certainly disappointing to see that Shenzhen Hepalink Pharmaceutical Group shares lost 15% throughout the year, that wasn't as bad as the market loss of 17%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 3% over the last half decade. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Shenzhen Hepalink Pharmaceutical Group .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.