Shandong Swan CottonIndustrial Machinery Stock Co.,Ltd. (SHSE:603029) shareholders might be concerned after seeing the share price drop 18% in the last month. But that doesn't detract from the splendid returns of the last year. Like an eagle, the share price soared 130% in that time. So it is important to view the recent reduction in price through that lense. More important, going forward, is how the business itself is going.

Although Shandong Swan CottonIndustrial Machinery StockLtd has shed CN¥363m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Shandong Swan CottonIndustrial Machinery StockLtd

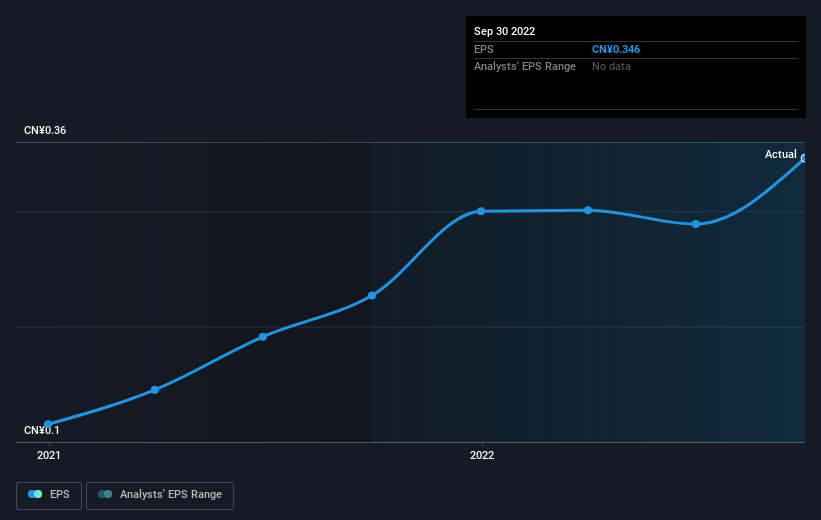

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Shandong Swan CottonIndustrial Machinery StockLtd was able to grow EPS by 52% in the last twelve months. The share price gain of 130% certainly outpaced the EPS growth. So it's fair to assume the market has a higher opinion of the business than it a year ago. The fairly generous P/E ratio of 69.15 also points to this optimism.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

SHSE:603029 Earnings Per Share Growth December 14th 2022

SHSE:603029 Earnings Per Share Growth December 14th 2022Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

We're pleased to report that Shandong Swan CottonIndustrial Machinery StockLtd shareholders have received a total shareholder return of 132% over one year. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 10%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Shandong Swan CottonIndustrial Machinery StockLtd better, we need to consider many other factors. For instance, we've identified 2 warning signs for Shandong Swan CottonIndustrial Machinery StockLtd (1 doesn't sit too well with us) that you should be aware of.

We will like Shandong Swan CottonIndustrial Machinery StockLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.