The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Gushengtang Holdings Limited (HKG:2273) share price is 60% higher than it was a year ago, much better than the market decline of around 19% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! We'll need to follow Gushengtang Holdings for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

In light of the stock dropping 3.9% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

See our latest analysis for Gushengtang Holdings

Gushengtang Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Gushengtang Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

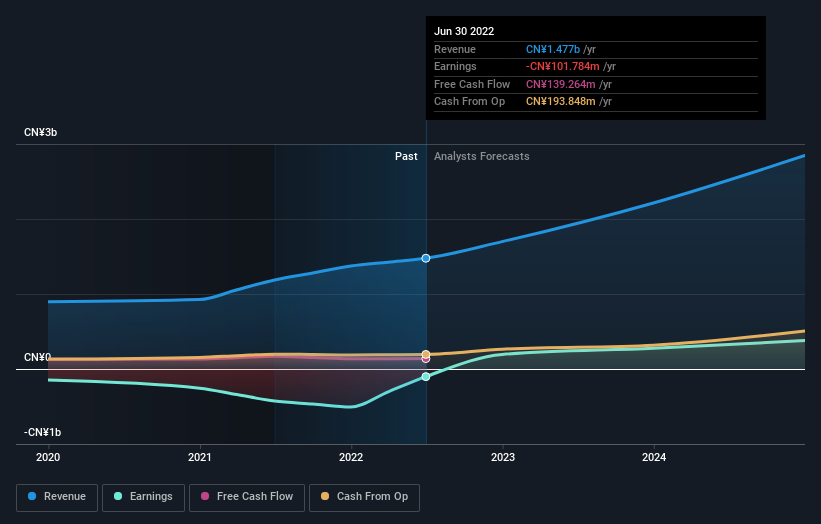

Over the last twelve months, Gushengtang Holdings' revenue grew by 24%. We respect that sort of growth, no doubt. While the share price performed well, gaining 60% over twelve months, you could argue the revenue growth warranted it. If revenue stays on trend, there may be plenty more share price gains to come. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

SEHK:2273 Earnings and Revenue Growth December 14th 2022

SEHK:2273 Earnings and Revenue Growth December 14th 2022Take a more thorough look at Gushengtang Holdings' financial health with this free report on its balance sheet.

A Different Perspective

Gushengtang Holdings shareholders should be happy with the total gain of 60% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 36% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.