Kwoon Chung Bus Holdings Limited (HKG:306) shareholders will doubtless be very grateful to see the share price up 50% in the last month. But if you look at the last five years the returns have not been good. In fact, the share price is down 39%, which falls well short of the return you could get by buying an index fund.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Kwoon Chung Bus Holdings

Kwoon Chung Bus Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last five years Kwoon Chung Bus Holdings saw its revenue shrink by 20% per year. That's definitely a weaker result than most pre-profit companies report. It seems pretty reasonable to us that the share price dipped 7% per year in that time. This loss means the stock shareholders are probably pretty annoyed. Risk averse investors probably wouldn't like this one much.

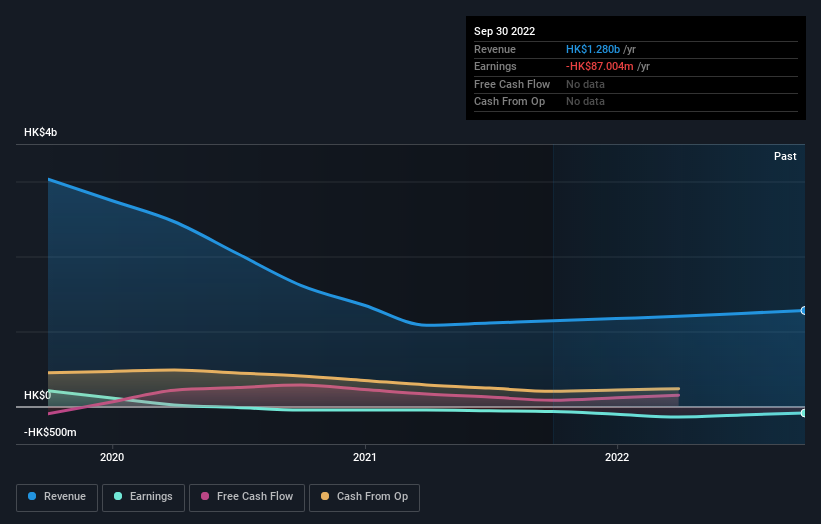

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

SEHK:306 Earnings and Revenue Growth December 13th 2022

SEHK:306 Earnings and Revenue Growth December 13th 2022Take a more thorough look at Kwoon Chung Bus Holdings' financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Kwoon Chung Bus Holdings' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Kwoon Chung Bus Holdings shareholders, and that cash payout explains why its total shareholder loss of 34%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

It's good to see that Kwoon Chung Bus Holdings has rewarded shareholders with a total shareholder return of 29% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 6% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Kwoon Chung Bus Holdings better, we need to consider many other factors. For example, we've discovered 2 warning signs for Kwoon Chung Bus Holdings that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.