Fu Shek Financial Holdings Limited (HKG:2263) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

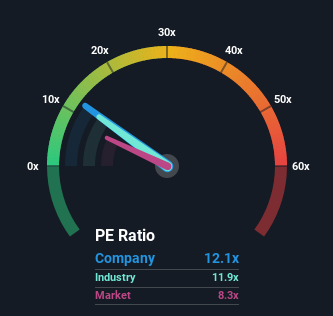

Following the firm bounce in price, Fu Shek Financial Holdings may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 12.1x, since almost half of all companies in Hong Kong have P/E ratios under 8x and even P/E's lower than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Earnings have risen firmly for Fu Shek Financial Holdings recently, which is pleasing to see. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Fu Shek Financial Holdings

SEHK:2263 Price Based on Past Earnings November 22nd 2022 We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Fu Shek Financial Holdings' earnings, revenue and cash flow.

SEHK:2263 Price Based on Past Earnings November 22nd 2022 We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Fu Shek Financial Holdings' earnings, revenue and cash flow. Does Growth Match The High P/E?

In order to justify its P/E ratio, Fu Shek Financial Holdings would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 20% gain to the company's bottom line. Still, incredibly EPS has fallen 75% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 18% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that Fu Shek Financial Holdings' P/E sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Fu Shek Financial Holdings' P/E is getting right up there since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Fu Shek Financial Holdings currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 4 warning signs we've spotted with Fu Shek Financial Holdings (including 2 which don't sit too well with us).

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.