The Shuang Yun Holdings Limited (HKG:1706) share price has fared very poorly over the last month, falling by a substantial 28%. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

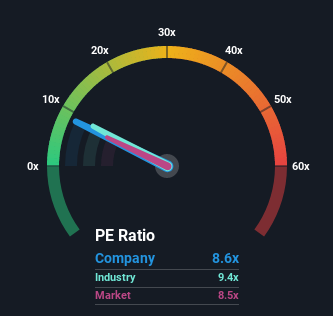

In spite of the heavy fall in price, it's still not a stretch to say that Shuang Yun Holdings' price-to-earnings (or "P/E") ratio of 8.6x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's exceedingly strong of late, Shuang Yun Holdings has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Shuang Yun Holdings

SEHK:1706 Price Based on Past Earnings November 16th 2022 Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shuang Yun Holdings will help you shine a light on its historical performance.

SEHK:1706 Price Based on Past Earnings November 16th 2022 Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shuang Yun Holdings will help you shine a light on its historical performance. Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Shuang Yun Holdings' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 115%. Still, incredibly EPS has fallen 39% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 18% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Shuang Yun Holdings is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

What We Can Learn From Shuang Yun Holdings' P/E?

With its share price falling into a hole, the P/E for Shuang Yun Holdings looks quite average now. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Shuang Yun Holdings currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 4 warning signs for Shuang Yun Holdings you should be aware of, and 2 of them make us uncomfortable.

If you're unsure about the strength of Shuang Yun Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.