The most worrying thing that surrounds fruit chain enterprises has happened.

In the evening of November eighth$Goertek Inc. (002241.SZ)$It issued a notice that it had received a notice from a major overseas customer to suspend production of one of its intelligent acoustic machine products, which is expected to affect business revenue of no more than 3.3 billion yuan in 2022.

Affected by the news, Gale shares directly hit the limit after the opening of trading on November 9, and as of the close of the day, there were still 2.996 million orders with a market value of 6.2 billion yuan to scramble to escape.

A number of sources in the market pointed out that the products suspended by the above-mentioned "big customers" are precisely the Airpods wireless headphones of Apple Inc, which Goll shares rely heavily on, and the reason for the "cut order" seems to point to the yield defects of its products.

The reason why the single-cutting scandal has attracted so much attention is that it has aroused concerns in the market about the growth of Gale shares and even how to keep Apple Inc's stock orders. Nearly 50% of the revenue of Gale shares reached 78.221 billion yuan in 2021. Nearly 50% come from the "customer one" of Apple Inc.

"at present, it is only a product for customers to be suspended on demand, and projects for other products are still working together normally." Goyle shares responded to ID:TradeWind01.

There is also speculation that Gore shares "lost" orders may be Lixun Precision (002475.SZ), AAC Technologies Holdings Inc. (2018.HK) to grab food.

In fact, long before the incident "landed", similar news circulated in the market, but Gale shares have not given a clear answer, and now there seems to be a "belated" notification has also made the timeliness of its information disclosure controversial.

"the company fulfills its disclosure obligations in strict accordance with the requirements of the letter." Gore shares responded to ID:TradeWind01, but even so, many institutional investors seem to have "smelled" the wind ahead of time to reduce their positions.

It is worth mentioning that although Goewe, a subsidiary of gem IPO, has just completed a meeting, the uncertainty about whether its subsequent registration will be affected by the incident is also growing-like Gale shares, its biggest customer is Apple Inc, which earned 1.768 billion yuan from Apple in 2021, accounting for more than half of the revenue.

In fact, there has long been discussion in the industry about the performance fragility reflected by the high dependence of the "fruit chain" enterprises represented by Gale shares on Apple Inc, and how to open up more potential customers or improve their anti-risk ability through business diversification, it may become a long-term and difficult proposition.

Or due to defects in yield.

"recently, I received a notice from a major customer abroad to suspend the production of one of its intelligent acoustic machine products. At present, the cooperation with other product projects with the customer is still in normal progress. " As the former leader of hundreds of billions of acoustic components, Gale shares suddenly released a "cut order" message on the evening of November 8, causing an uproar in the market.

Because the market generally believes that this is not a clear "overseas customer" is its heavy reliance on the Apple Inc company.

"this product may be Apple's AirPods Pro 2, and Gore's suspension of production is more likely to be due to production problems than demand problems." Guo Mingyi, an analyst at Tianfeng International Electronics Industry, said on the social platform.

According to Goyle shares, the impact of this incident on 2022 revenue will be no more than 3.3 billion yuan, accounting for 4.2% of the previous year's revenue. "the impact of this matter on the company's operating results is still being assessed. The company will promote the relevant evaluation work as soon as possible and fulfill its information disclosure obligations in accordance with the requirements of relevant laws and regulations. " Gore shares said.

In 2021, Goehl's intelligent acoustics business revenue was 30.297 billion yuan, which means that the above "cut" orders accounted for about 1/10 of Gale's business.

Some market analysts have pointed out that the production problem seems to point to the counterfeiting of the yield of the product. This index is the guarantee of product quality, and the higher the yield, the better the product quality.

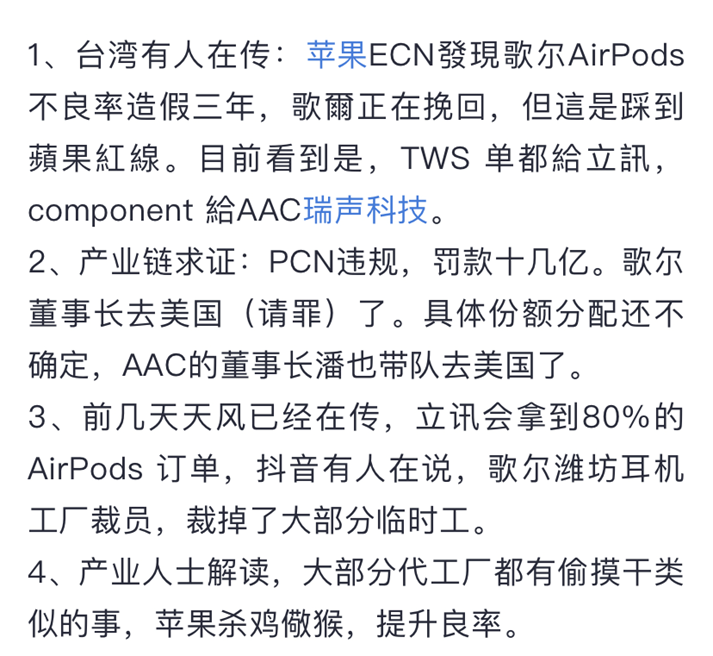

"Apple Inc ECN found that Gore's AirPods defect rate was faked for three years, and Gore is recovering, but this is stepping on Apple Inc's red line." An anecdotal piece of market news pointed out so.

"Apple Inc's demand for yield is very high, but the price pressure is very low. It is difficult for the next generation of factories in the existing price system to achieve this level of yield, so there will be yield fraud, which is also more common in the industry." A consumer electronics industry analyst said.

Gale shares did not give a clear answer to this, its trade wind (ID:TradeWind01) said: "the relevant matters are subject to the company announcement, some rumors on the Internet, please pay attention to the screening."

Some people are happy and others are sad.

Behind the loss of orders for GE'er shares, some analysts believe that orders for relevant intelligent acoustics products may be "cut off" by similar enterprises such as Lixun Precision, AAC Technologies Holdings Inc. and so on.

Guo Mingyi pointed out that AAC Technologies Holdings Inc. is not responsible for the assembly of the whole machine, and this incident has nothing to do with it, and if Lixun Precision takes this share, it will directly increase its revenue by about 3 billion yuan in the fourth quarter.

From the perspective of business structure, AAC Technologies Holdings Inc. 's acoustics business mainly focuses on MEMS microphones rather than whole machine products, and the possibility of this order going to AAC Technologies Holdings Inc. may be relatively limited.

In contrast, Lixun Precision, which has upgraded from consumer electronics components and modules to the whole machine system, may be able to gain more advantages in this order storm.

The reduction of holdings and "according to the soldiers" behind the dispute of letter clothing

Rumors of customer loss have been hovering over the market long before the official announcement of Gore shares.

ID:TradeWind01 noted that as early as the end of October 2022, the news that Gale shares had been unsubscribed by major customers spread in the market, but Gale shares did not make any further response or clarification at that time.

Today's boots fall to the ground, there is no doubt that the timeliness of the information disclosure of Gore shares, which was previously "silent", has been more questioned.

"the news has been circulated in the market before, but Gore has not responded to the specific situation and progress." The investment manager of a private equity firm in Beijing said: "in fact, whether it is the loss of orders or the rate of good products, it is obvious that the loss of such a large amount of business will not be achieved overnight, and there will certainly be a process of negotiation and negotiation. But Gore did not explain it to the market, even if it was clarified."

Some analysts believe that due to the greater market impact of the incident, Gale shares should make more explanations and make more detailed predictions on the business impact.

"after all, it is a fruit chain leader, and the fate of this kind of business has a great impact on the company and even the industry. Gore should explain the reason for this in more detail, or clarify whether it has anything to do with the yield."

Gore doesn't seem to think there's a problem with its letter coat. "the company strictly complies with its disclosure obligations in accordance with the requirements of the letter," it responded to ID:TradeWind01 on November 9.

However, contrary to this statement, many organizations have implemented "precise escape" before the official announcement of the incident.

From the position point of view, including Yi Fangda, Oriental Capital Management, Baoying and other institutions' products decreased significantly in the third quarter of 2022.

By the end of the first half of 2022, the fund products owned by Yi Fangda, Dongfanghong and Baoying had 34, 20 and 17 shares respectively, but by the end of the third quarter, they had dropped to 7, 5 and 10, and the proportion of positions had also dropped from 2.63%, 0.70% and 0.46% to 1.81%, 0.10% and 0.41%, respectively.

However, there are also some fund products that still have more allocation in Gore shares.

As of the third quarter of 2022, the four public offerings managed by Yi Fangda Feng Bo still hold a total of 53.4965 million Goyle shares, with a total shareholding ratio of 1.78%. Two funds owned by Zheng Yu of Huaxia hold a total of 3.36 million Goyle shares and hold 0.11% of Prida.

The problem of "fragility" of fruit chain

As the leader of acoustic components in the field of consumer electronics, the cooperation between Gale shares and Apple Inc can be traced back to 2010. With the improvement of mobile phone penetration, Gale shares also started a journey of performance take-off led by Apple Inc and other major customers.

In the nine years from 2012 to 2021, Goyle shares increased from 7.253 billion yuan to 78.221 billion yuan, an increase of more than 10 times.

However, due to the increase in the concentration of the smartphone market, the "fruit content" of Gale shares is also rising in a straight line. Its income from Apple Inc in 2016 was only 5.161 billion yuan, accounting for only 26.76%. However, by 2020, its income from Apple Inc reached 27.76 billion yuan, accounting for nearly half of the income.

It needs to be emphasized that Gale shares rely on Apple Inc not only at the parent company level. In October, Goewe spun off its MEMS sensor and microsystem module subsidiary to IPO and received a meeting on gem, but so far the company has not yet submitted an application for registration with the CSRC.

According to the prospectus, Golfei's revenue from Apple Inc reached 1.768 billion yuan in 2021, accounting for 52.81%; and whether the "unsubscription storm" between Golmud and Apple Inc may also have a potential impact on Golwei's related business and have an impact on its IPO, this uncertainty is quietly increasing.

From the point of view of the industry, although the "fruit chain" enterprises represented by Gale shares have been driven by the high growth cycle of consumer electronics in recent years, the objective problem of dependence on large customers is still a fragility curse that it is difficult to get rid of.

"the advantage of most domestic mobile phone suppliers is the result of large-scale mass production and superimposed cost advantage. That is to say, it can guarantee a certain price advantage on the premise of ensuring the quality of mass production. " The private equity investment manager pointed out, "but at present, one of the problems of 'fruit chain' companies is that the penetration of smartphones may be becoming saturated, the degree of volume in the industry is deepening, and mobile phone manufacturers will begin to further control costs for profit reasons." and this pressure will be transmitted upstream. "

"it is the excess income earned by this in the early stage, but after the reversal of the large industry in the later stage, some potential problems will be gradually exposed." The above-mentioned investment manager said.

In fact, Gale shares is not the first "fruit chain" company with major customer risk. As early as March 2021, 002456.SZ announced the termination of its cooperation with Apple Inc's "specific overseas customers", which has become an important symbol of risk exposure for major customers of "fruit chain" enterprises in recent years.

Since being kicked out of the "fruit chain", Oufeiguang has not only faced the pressure of shrinking income, but has also frequently recorded large impairment since then.

In 2021, Ofeiguang's operating income and return net profit were 22.844 billion yuan and-2.525 billion yuan respectively, the former down 52.75% from the same period last year, while the latter's loss expanded by 34.99%.

In the first three quarters of 2022, Ofeiguang's revenue fell by a further 37.06% compared with the same period last year, with a loss of 3.281 billion yuan, and a cumulative provision for asset impairment of 1.496 billion yuan in the same period.

The "fall" of fundamentals has dealt a heavy blow to the secondary market price of Ofeiguang, which has lost more than 50 billion yuan in market value since its peak in July 2020.

However, it is not possible to draw a simple analogy between Gore shares and Ofeiguang. The reason is that Ofeiguang's thunderstorm began with the complete termination of its cooperation with Apple Inc, and at present, the business loss of Gore shares is limited to a particular product. But now the tension around Gale shares also points to another potential concern in the market-whether the return risk of the headset business will further spread to other businesses.

In fact, Gale's gross profit margin has fallen sharply in recent years under the "inner volume" trend of consumer electronics.

According to the data, Gale's gross margin fell from 25.79% in 2012 to 14.13% in 2021, a decline of 11.49 percentage points in nine years; its net sales margin in 2021 was only 5.51%, down 7.22 percentage points from nine years ago.

"although Gale shares may not necessarily become the second place in Ofeiguang, it is difficult to maintain its current position in the Apple Inc system." The above-mentioned electronics industry analysts pointed out. "Apple Inc's terminal price has not been significantly reduced, but it is constantly squeezing the profit share of the foundry, resulting in smaller and smaller profit space for the foundry."

In fact, Ofeiguang, Gale shares and other "fruit chain" enterprises are not unaware of the potential dangers of relying on the "fruit chain", but this road also seems to be easier known than done.

In order to get rid of the dependence on big customers such as Apple Inc, fruit chain enterprises such as Ofeiguang and Gale shares have also been actively diversifying their businesses in recent years. For example, Ofeiguang has made some efforts in smart cars, VR/AR and other fields. In the first half of 2022, the revenue of its smart car products was 596 million yuan, accounting for only 7.66%.

Gale also laid out all kinds of smart hardware such as VR/AR, wearable and home video games a few years ago. The business segment generated 43.552 billion yuan in revenue in the first three quarters of 2022, an increase of 95.87% over the same period last year, accounting for 58.73% of total revenue.

"Gore should still be optimistic, VR, AR, TWS, the main OEM is it." The consumer electronics industry analyst told ID:TradeWind01.

However, some people in the industry have pointed out that compared with the huge income obtained by the core terminal manufacturers, the ceiling of innovation business is mostly limited, so it is difficult to effectively replace the original business scale.

"the original production capacity is constant in an order of magnitude, and even if the new business is transformed and innovated, it is difficult to maintain the scale in the 'fruit chain' state, and the corresponding downward performance and asset impairment will take time to digest." The investment manager said frankly, "unless there is a new wave of terminal hardware replacement in the industry, 'success is also the leader, failure is also the leader' is likely to become the 'fate' of this kind of enterprises."