Source: Zhitong Finance and Economics

Author: Zhao Jinbin

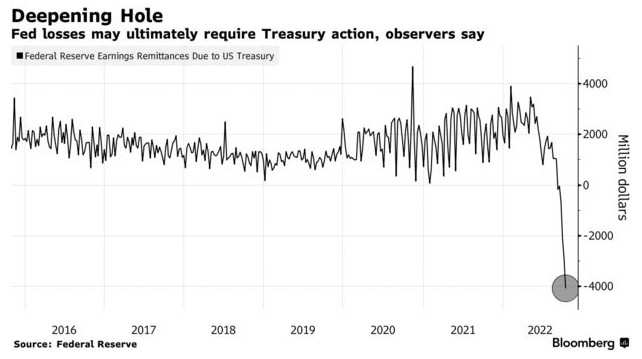

According to Amherst Pierpont Securities LLC, the US Treasury will see a "startling shift", from a profit of about $100 billion from the Fed last year to an annual loss of $80 billion by the end of the year.

Normally, profit or loss is not considered a factor for central banks to consider, but this time, the rapidly growing deficit of the Fed and many of its peers may have become more than just an accounting issue.

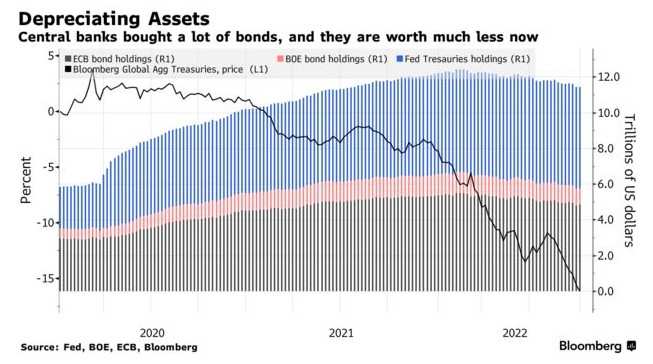

The bond market is experiencing its worst sell-off in three decades, triggered by high inflation and aggressive interest rate hikes being implemented by central banks. The fall in bond prices, in turn, means paper losses on a large number of bond assets accumulated by the Fed and other institutions in recent bailouts.

Raising interest rates also means that the central bank needs to pay more interest on the reserves of commercial banks. This will plunge the Fed and other central banks into operating losses, leading to a loophole that may eventually need to be filled by the Treasury by issuing bonds. At present, the Treasury is already preparing to make up for the losses of the Bank of England.

The UK's move highlights a big shift in countries, including the US, whose central banks are no longer important contributors to government revenues. According to Amherst Pierpont Securities LLC, the US Treasury will see a "startling shift", from a profit of about $100 billion from the Fed last year to an annual loss of $80 billion by the end of the year.

The following are the operating losses or mark-to-market balance sheet losses of some central banks:

As of Oct. 19, the Fed's remittances to the U.S. Treasury reached minus $5.3 billion, compared with a positive figure at the end of August. A negative number is equivalent to an IOU, which will be repaid through any future income

In the 12 months to June this year, the RBA posted an accounting loss of A $36.7 billion (US $23 billion), bringing its negative equity status to A $12.4 billion.

Klaas Knot, governor of the Dutch central bank, warned last month that the central bank is expected to lose about 9 billion euros ($8.8 billion) in the next few years.

The SNB had previously reported a loss of 95.2 billion Swiss francs ($95 billion) in the first six months of this year due to a sharp drop in the value of its foreign exchange reserves, its worst first-half performance since it was founded in 1907.

These accounting losses are likely to exacerbate criticism of asset purchases designed to save markets and the economy (most recently in 2020, when the COVID-19 epidemic brought the global economy to a standstill). And, at a time of current inflation, it is likely to prompt calls to rein in the independence of monetary policymakers or limit what they can do in the next crisis.

"the problem with central bank losses is not the losses themselves-they can be recapitalised at any time-but that the central banks are likely to face more and more political counterattacks," said Jerome Haegeli, chief economist at Swiss Reinsurance.

While central bank losses can undermine confidence and lead to widespread capital outflows for a developing country, such a creditworthiness challenge is unlikely for rich countries.

As Seth Carpenter, chief global economist of Morgan Stanley and a former US Treasury official, said: "these losses will not have a material impact on their ability to implement monetary policy in the short term."

Last month, RBA Vice Chairman Bullock also said in response to a question about its negative equity situation, "We do not think our ability to operate has been affected in any way." After all, "We can create money. That's what we do when we buy bonds.

But there are still some consequences. Central banks themselves admit that persistent losses have once again attracted criticism. Over the past year or so, they have failed to foresee and act quickly to deal with emerging inflation, so they have become political institutions. Losses have become "another magnet for criticism".

Impact on the ECB and the Federal Reserve

In the case of the ECB, while conservative officials have argued in the past that sovereign debt purchases have led to "blurring the line between monetary and fiscal policy", the move could lead to mounting losses.

And as inflation reaches five times the ECB's target, there will be increasing pressure on it to sell bonds (a process known as quantitative tightening). With the economic outlook increasingly bleak, the ECB is also grappling with the problem.

"although the ECB's losses are not subject to obvious economic constraints, it is likely to become a political constraint," said Goldman Sachs Group economists George Cole and Simon Freycenet. In northern Europe in particular, this "may fuel the discussion of quantitative austerity".

So far, however, ECB President Christine Lagarde has given no sign that the ECB's decision to quantify austerity will be affected by the outlook for losses. Last month, she told lawmakers in Brussels that generating profits was not part of the central bank's task, insisting that fighting inflation remained the "sole purpose" of policy makers.

As for the Fed, Republicans have in the past expressed opposition to its practice of paying interest on banks' surplus reserves. As early as 2008, Congress granted this power to help the Fed control interest rates. With the Fed now suffering losses and Republicans likely to regain control of at least one of the House and Senate in November's mid-term elections, the debate may resurface.

The Fed's shift from profit to loss is likely to be particularly striking. Stephen Stanley, chief economist of the Amherst Pierpont, estimates that after paying up to $100 billion to the Treasury in 2021, the Fed could face losses of more than $80 billion a year if policymakers raise interest rates by 75 basis points and 50 basis points in November and December, respectively, as expected.

Without Fed revenue, the Treasury would need to sell more debt to the public to fund government spending.

"this may not attract public attention, but populists may make up stories in a way that is bad for the Fed," Stanley said.

Edit / tolk