Investing in stocks comes with the risk that the share price will fall. And there's no doubt that Align Technology, Inc. (NASDAQ:ALGN) stock has had a really bad year. The share price is down a hefty 68% in that time. On the bright side, the stock is actually up 14% in the last three years. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days.

Since Align Technology has shed US$542m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Align Technology

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

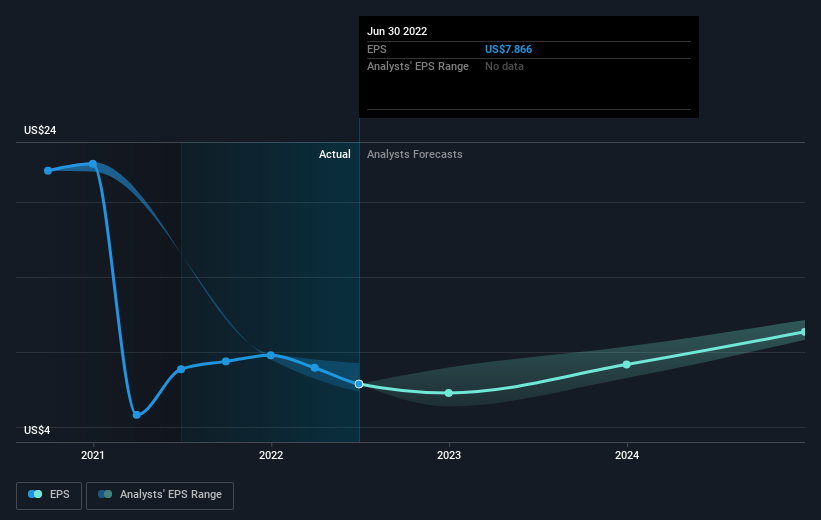

Unhappily, Align Technology had to report a 11% decline in EPS over the last year. The share price decline of 68% is actually more than the EPS drop. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

NasdaqGS:ALGN Earnings Per Share Growth September 30th 2022

NasdaqGS:ALGN Earnings Per Share Growth September 30th 2022We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Align Technology's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 20% in the twelve months, Align Technology shareholders did even worse, losing 68%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 2% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Align Technology is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.