Even the best investor on earth makes unsuccessful investments. But it's not unreasonable to try to avoid truly shocking capital losses. So we hope that those who held Berkeley Lights, Inc. (NASDAQ:BLI) during the last year don't lose the lesson, in addition to the 87% hit to the value of their shares. That'd be enough to make even the strongest stomachs churn. Berkeley Lights hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 35% in about a quarter. That's not much fun for holders. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

If the past week is anything to go by, investor sentiment for Berkeley Lights isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Berkeley Lights

Because Berkeley Lights made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Berkeley Lights grew its revenue by 12% over the last year. While that may seem decent it isn't great considering the company is still making a loss. Even so you could argue that it's surprising that the share price has tanked 87%. Clearly the market was expecting better, and this may blow out projections of profitability. But if it will make money, albeit later than previously believed, this could be an opportunity.

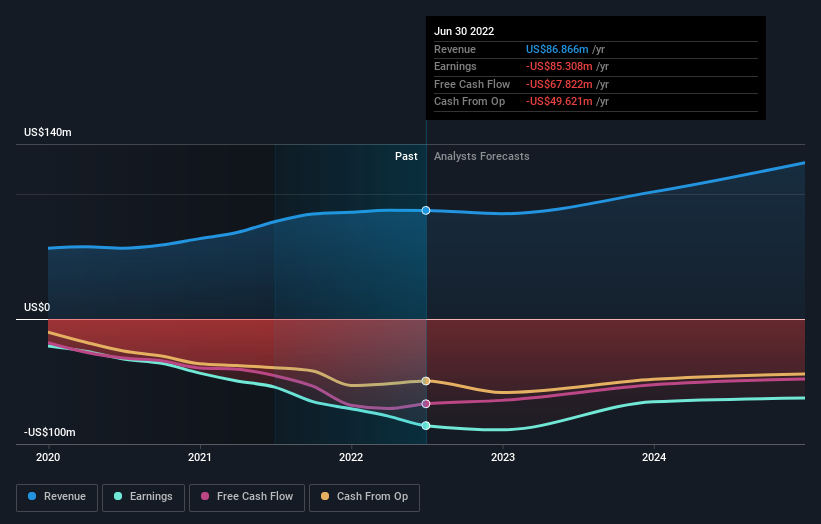

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

NasdaqGS:BLI Earnings and Revenue Growth September 20th 2022

NasdaqGS:BLI Earnings and Revenue Growth September 20th 2022We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We doubt Berkeley Lights shareholders are happy with the loss of 87% over twelve months. That falls short of the market, which lost 15%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 35% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Berkeley Lights better, we need to consider many other factors. Take risks, for example - Berkeley Lights has 2 warning signs we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.