Jiangxi Bank Co., Ltd. (HKG:1916) shareholders should be happy to see the share price up 13% in the last month. But only the myopic could ignore the astounding decline over three years. To wit, the share price sky-dived 81% in that time. So it sure is nice to see a bit of an improvement. Of course the real question is whether the business can sustain a turnaround. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

While the stock has risen 8.4% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Jiangxi Bank

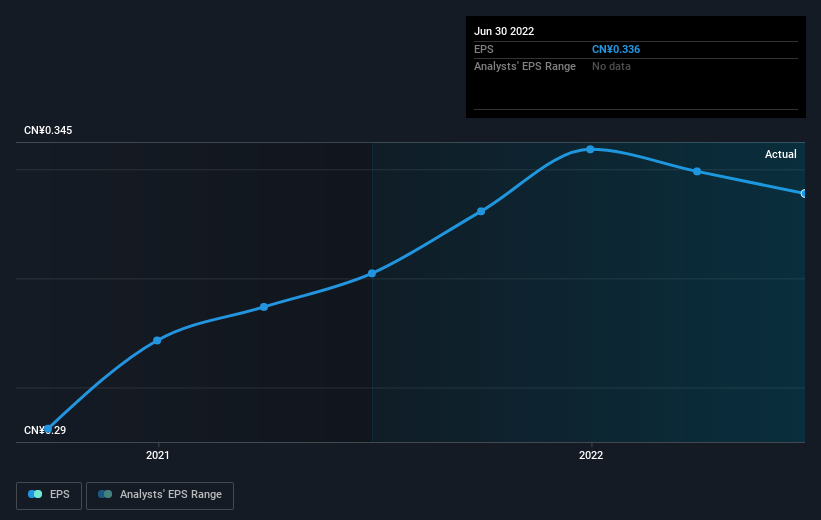

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Jiangxi Bank saw its EPS decline at a compound rate of 10% per year, over the last three years. The share price decline of 42% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. This increased caution is also evident in the rather low P/E ratio, which is sitting at 2.39.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

SEHK:1916 Earnings Per Share Growth September 20th 2022

SEHK:1916 Earnings Per Share Growth September 20th 2022Dive deeper into Jiangxi Bank's key metrics by checking this interactive graph of Jiangxi Bank's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Jiangxi Bank shares, which performed worse than the market, costing holders 72%, including dividends. The market shed around 21%, no doubt weighing on the stock price. Shareholders have lost 21% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Jiangxi Bank (at least 2 which don't sit too well with us) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.