When you buy shares in a company, there is always a risk that the price drops to zero. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the China Chunlai Education Group Co., Ltd. (HKG:1969) share price has soared 114% return in just a single year. It's also good to see the share price up 47% over the last quarter. And shareholders have also done well over the long term, with an increase of 88% in the last three years.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for China Chunlai Education Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

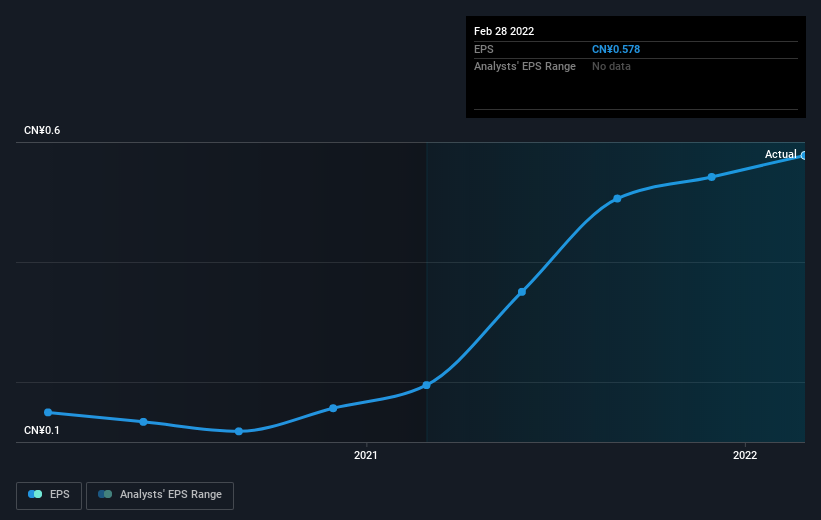

During the last year China Chunlai Education Group grew its earnings per share (EPS) by 197%. It's fair to say that the share price gain of 114% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about China Chunlai Education Group as it was before. This could be an opportunity. This cautious sentiment is reflected in its (fairly low) P/E ratio of 4.64.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

SEHK:1969 Earnings Per Share Growth September 14th 2022

SEHK:1969 Earnings Per Share Growth September 14th 2022We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of China Chunlai Education Group's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that China Chunlai Education Group shareholders have gained 114% (in total) over the last year. That's better than the annualized TSR of 23% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. It's always interesting to track share price performance over the longer term. But to understand China Chunlai Education Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with China Chunlai Education Group , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.