While it's been a great week for Greene County Bancorp, Inc. (NASDAQ:GCBC) shareholders after stock gained 12%, they should consider it with a grain of salt. Even though stock prices were relatively low, insiders elected to sell US$630k worth of stock in the last year, which could indicate some expected downturn.

While insider transactions are not the most important thing when it comes to long-term investing, we do think it is perfectly logical to keep tabs on what insiders are doing.

View our latest analysis for Greene County Bancorp

Greene County Bancorp Insider Transactions Over The Last Year

The President, Donald Gibson, made the biggest insider sale in the last 12 months. That single transaction was for US$275k worth of shares at a price of US$55.00 each. So it's clear an insider wanted to take some cash off the table, even below the current price of US$60.00. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 5.2% of Donald Gibson's stake.

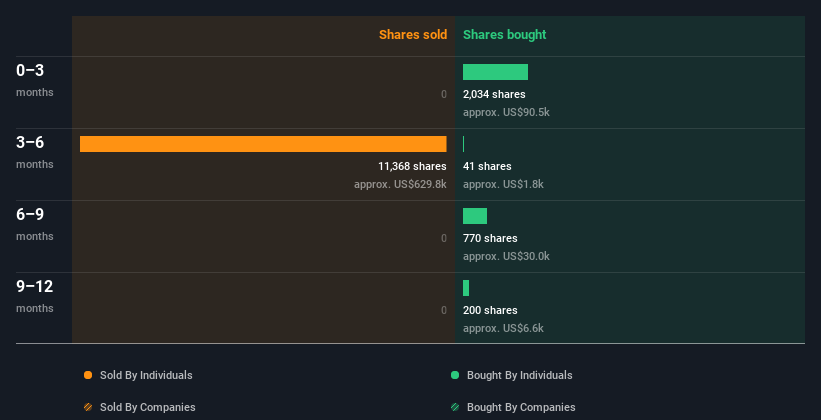

Over the last year, we can see that insiders have bought 3.05k shares worth US$130k. On the other hand they divested 11.37k shares, for US$630k. All up, insiders sold more shares in Greene County Bancorp than they bought, over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

NasdaqCM:GCBC Insider Trading Volume September 13th 2022

NasdaqCM:GCBC Insider Trading Volume September 13th 2022If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insiders At Greene County Bancorp Have Bought Stock Recently

Over the last three months, we've seen a bit of insider buying at Greene County Bancorp. Independent Director Jay Cahalan bought US$48k worth of shares in that time. It's good to see the insider buying, as well as the lack of recent sellers. However, in this case the amount invested recently is quite small.

Does Greene County Bancorp Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. It appears that Greene County Bancorp insiders own 6.6% of the company, worth about US$34m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

What Might The Insider Transactions At Greene County Bancorp Tell Us?

Our data shows a little insider buying, but no selling, in the last three months. That said, the purchases were not large. Still, the insider transactions at Greene County Bancorp in the last 12 months are not very heartening. But it's good to see that insiders own shares in the company. I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

Of course Greene County Bancorp may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.