Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Sembcorp Industries Ltd (SGX:U96) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Sembcorp Industries

What Is Sembcorp Industries's Net Debt?

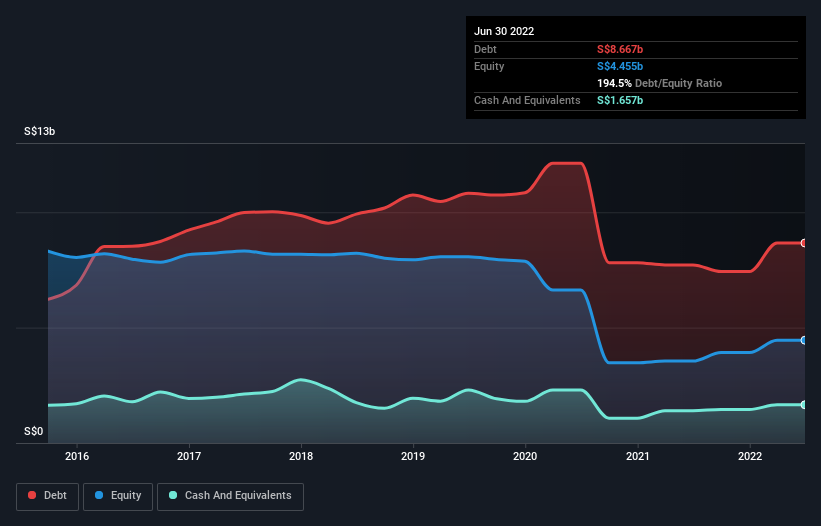

You can click the graphic below for the historical numbers, but it shows that as of June 2022 Sembcorp Industries had S$8.67b of debt, an increase on S$7.72b, over one year. However, it also had S$1.66b in cash, and so its net debt is S$7.01b.

You can click the graphic below for the historical numbers, but it shows that as of June 2022 Sembcorp Industries had S$8.67b of debt, an increase on S$7.72b, over one year. However, it also had S$1.66b in cash, and so its net debt is S$7.01b.

SGX:U96 Debt to Equity History September 9th 2022

SGX:U96 Debt to Equity History September 9th 2022A Look At Sembcorp Industries' Liabilities

Zooming in on the latest balance sheet data, we can see that Sembcorp Industries had liabilities of S$3.67b due within 12 months and liabilities of S$8.70b due beyond that. On the other hand, it had cash of S$1.66b and S$2.58b worth of receivables due within a year. So it has liabilities totalling S$8.14b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's S$6.00b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Sembcorp Industries's debt is 4.9 times its EBITDA, and its EBIT cover its interest expense 2.7 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. On the other hand, Sembcorp Industries grew its EBIT by 26% in the last year. If sustained, this growth should make that debt evaporate like a scarce drinking water during an unnaturally hot summer. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Sembcorp Industries can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Sembcorp Industries recorded free cash flow of 49% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

To be frank both Sembcorp Industries's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at growing its EBIT; that's encouraging. It's also worth noting that Sembcorp Industries is in the Integrated Utilities industry, which is often considered to be quite defensive. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Sembcorp Industries stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with Sembcorp Industries (including 2 which are a bit unpleasant) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.