It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Ingdan (HKG:400), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Ingdan

How Quickly Is Ingdan Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that Ingdan has grown EPS by 53% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

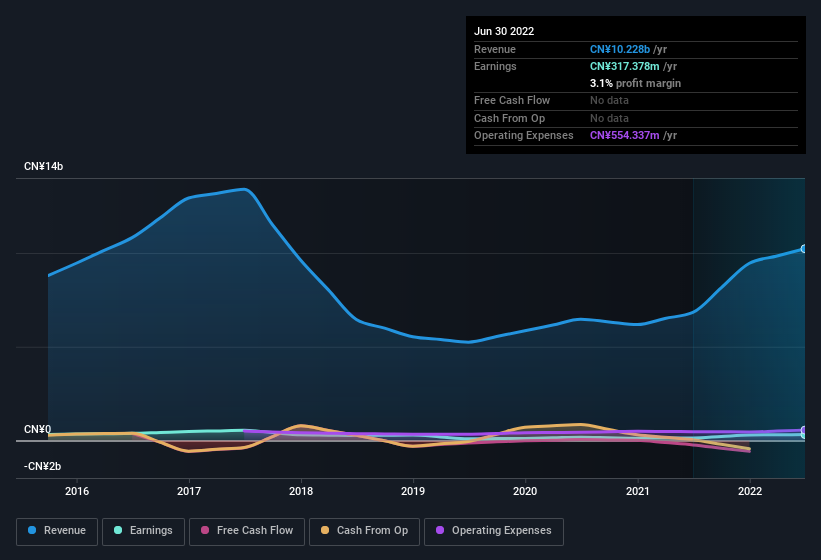

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Ingdan maintained stable EBIT margins over the last year, all while growing revenue 50% to CN¥10b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

SEHK:400 Earnings and Revenue History September 9th 2022

SEHK:400 Earnings and Revenue History September 9th 2022Ingdan isn't a huge company, given its market capitalisation of HK$2.2b. That makes it extra important to check on its balance sheet strength.

Are Ingdan Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Ingdan insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 60%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. With that sort of holding, insiders have about CN¥1.3b riding on the stock, at current prices. That's nothing to sneeze at!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Ingdan with market caps between CN¥697m and CN¥2.8b is about CN¥2.1m.

The Ingdan CEO received CN¥1.0m in compensation for the year ending December 2021. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Ingdan Deserve A Spot On Your Watchlist?

Ingdan's earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Ingdan is certainly doing some things right and is well worth investigating. Even so, be aware that Ingdan is showing 1 warning sign in our investment analysis , you should know about...

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.