It might be of some concern to shareholders to see the SPS Commerce, Inc. (NASDAQ:SPSC) share price down 11% in the last month. But that doesn't change the fact that the returns over the last five years have been very strong. Indeed, the share price is up an impressive 298% in that time. We think it's more important to dwell on the long term returns than the short term returns. The more important question is whether the stock is too cheap or too expensive today.

Since the long term performance has been good but there's been a recent pullback of 5.9%, let's check if the fundamentals match the share price.

View our latest analysis for SPS Commerce

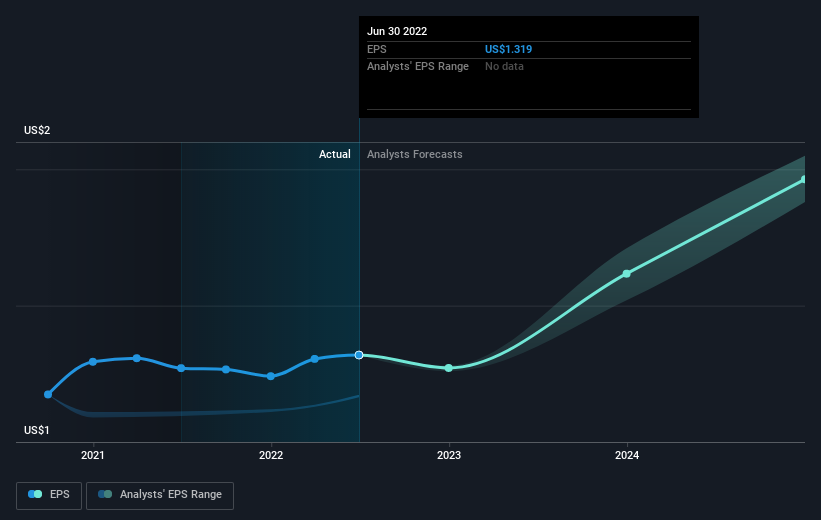

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, SPS Commerce managed to grow its earnings per share at 37% a year. This EPS growth is reasonably close to the 32% average annual increase in the share price. This indicates that investor sentiment towards the company has not changed a great deal. Rather, the share price has approximately tracked EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

NasdaqGS:SPSC Earnings Per Share Growth September 5th 2022

NasdaqGS:SPSC Earnings Per Share Growth September 5th 2022Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While it's certainly disappointing to see that SPS Commerce shares lost 13% throughout the year, that wasn't as bad as the market loss of 18%. Longer term investors wouldn't be so upset, since they would have made 32%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. Is SPS Commerce cheap compared to other companies? These 3 valuation measures might help you decide.

But note: SPS Commerce may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.