When we invest, we're generally looking for stocks that outperform the market average. Buying under-rated businesses is one path to excess returns. To wit, the Haisco Pharmaceutical Group share price has climbed 50% in five years, easily topping the market return of 5.1% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 13% , including dividends .

While the stock has fallen 5.5% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Haisco Pharmaceutical Group

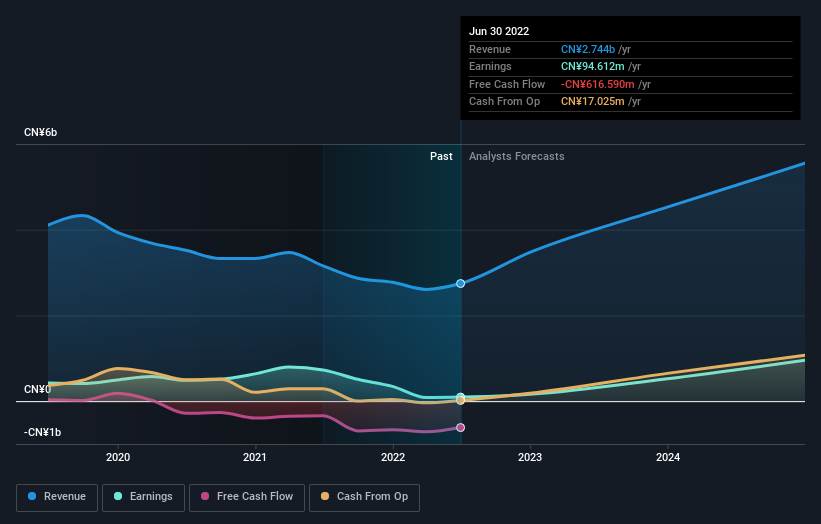

We don't think that Haisco Pharmaceutical Group's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Haisco Pharmaceutical Group can boast revenue growth at a rate of 6.5% per year. That's a fairly respectable growth rate. While the share price has beat the market, compounding at 8% yearly, over five years, there's certainly some potential that the market hasn't fully considered the growth track record. The key question is whether revenue growth will slow down, and if so, how quickly. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

SZSE:002653 Earnings and Revenue Growth August 30th 2022

SZSE:002653 Earnings and Revenue Growth August 30th 2022You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Haisco Pharmaceutical Group's TSR for the last 5 years was 61%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Haisco Pharmaceutical Group shareholders have received a total shareholder return of 13% over the last year. Of course, that includes the dividend. That's better than the annualised return of 10% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Haisco Pharmaceutical Group better, we need to consider many other factors. Take risks, for example - Haisco Pharmaceutical Group has 3 warning signs (and 2 which can't be ignored) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.