With its stock down 7.7% over the past three months, it is easy to disregard China Foods (HKG:506). However, stock prices are usually driven by a company's financials over the long term, which in this case look pretty respectable. Specifically, we decided to study China Foods' ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors' money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for China Foods

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for China Foods is:

14% = CN¥1.2b ÷ CN¥8.6b (Based on the trailing twelve months to June 2022).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each HK$1 of shareholders' capital it has, the company made HK$0.14 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of China Foods' Earnings Growth And 14% ROE

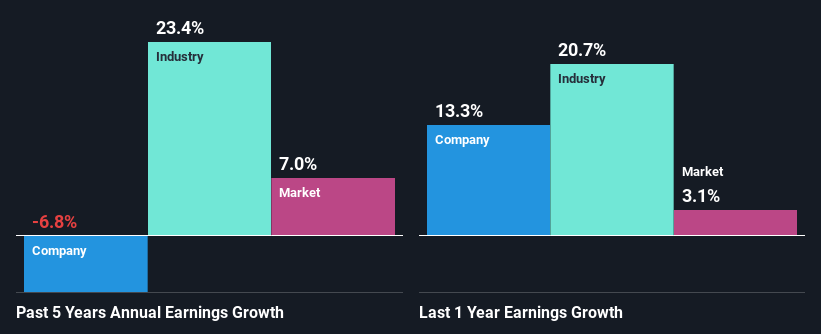

To begin with, China Foods seems to have a respectable ROE. On comparing with the average industry ROE of 7.0% the company's ROE looks pretty remarkable. For this reason, China Foods' five year net income decline of 6.8% raises the question as to why the high ROE didn't translate into earnings growth. Based on this, we feel that there might be other reasons which haven't been discussed so far in this article that could be hampering the company's growth. Such as, the company pays out a huge portion of its earnings as dividends, or is faced with competitive pressures.

That being said, we compared China Foods' performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 23% in the same period.

SEHK:506 Past Earnings Growth August 29th 2022

SEHK:506 Past Earnings Growth August 29th 2022Earnings growth is a huge factor in stock valuation. It's important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is 506 fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is China Foods Using Its Retained Earnings Effectively?

Looking at its three-year median payout ratio of 36% (or a retention ratio of 64%) which is pretty normal, China Foods' declining earnings is rather baffling as one would expect to see a fair bit of growth when a company is retaining a good portion of its profits. It looks like there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

In addition, China Foods has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to rise to 54% over the next three years. Regardless, the ROE is not expected to change much for the company despite the higher expected payout ratio.

Summary

In total, it does look like China Foods has some positive aspects to its business. Although, we are disappointed to see a lack of growth in earnings even in spite of a high ROE and and a high reinvestment rate. We believe that there might be some outside factors that could be having a negative impact on the business. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.