A look at the shareholders of China Communications Construction Company Limited (HKG:1800) can tell us which group is most powerful. The group holding the most number of shares in the company, around 59% to be precise, is private companies. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

And individual investors on the other hand have a 35% ownership in the company.

In the chart below, we zoom in on the different ownership groups of China Communications Construction.

Check out our latest analysis for China Communications Construction

SEHK:1800 Ownership Breakdown August 25th 2022

SEHK:1800 Ownership Breakdown August 25th 2022What Does The Institutional Ownership Tell Us About China Communications Construction?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

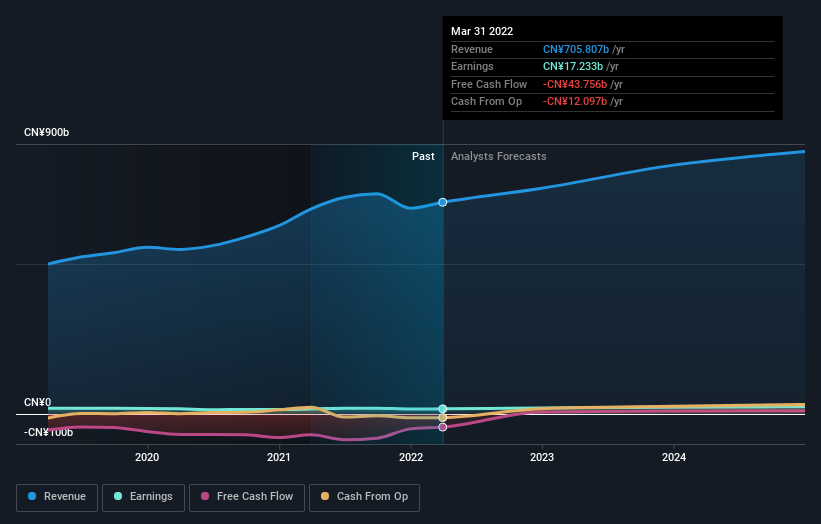

China Communications Construction already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see China Communications Construction's historic earnings and revenue below, but keep in mind there's always more to the story.

SEHK:1800 Earnings and Revenue Growth August 25th 2022

SEHK:1800 Earnings and Revenue Growth August 25th 2022We note that hedge funds don't have a meaningful investment in China Communications Construction. China Communications Construction Group (Ltd.) is currently the company's largest shareholder with 59% of shares outstanding. With such a huge stake in the ownership, we infer that they have significant control of the future of the company. With 3.0% and 0.6% of the shares outstanding respectively, China Securities Finance Corp, Asset Management Arm and Central Huijin Asset Management Ltd. are the second and third largest shareholders.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of China Communications Construction

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our data cannot confirm that board members are holding shares personally. It is unusual not to have at least some personal holdings by board members, so our data might be flawed. A good next step would be to take a look at this free summary of insider buying and selling.

General Public Ownership

The general public, who are usually individual investors, hold a 35% stake in China Communications Construction. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

It seems that Private Companies own 59%, of the China Communications Construction stock. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Be aware that China Communications Construction is showing 2 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.