Kindstar Globalgene Technology, Inc. (HKG:9960) announced strong profits, but the stock was stagnant. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

View our latest analysis for Kindstar Globalgene Technology

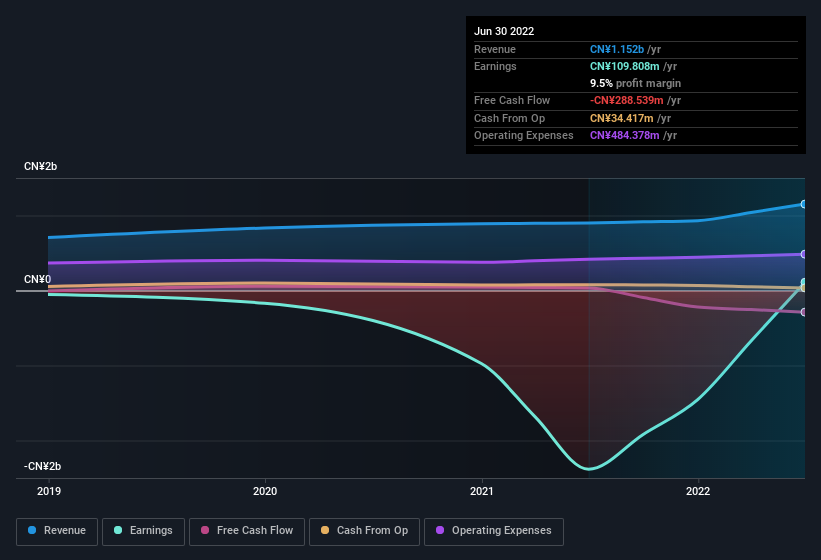

SEHK:9960 Earnings and Revenue History August 22nd 2022

SEHK:9960 Earnings and Revenue History August 22nd 2022Zooming In On Kindstar Globalgene Technology's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

For the year to June 2022, Kindstar Globalgene Technology had an accrual ratio of 0.83. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. Over the last year it actually had negative free cash flow of CN¥289m, in contrast to the aforementioned profit of CN¥109.8m. It's worth noting that Kindstar Globalgene Technology generated positive FCF of CN¥34m a year ago, so at least they've done it in the past. Having said that, there is more to consider. We must also consider the impact of unusual items on statutory profit (and thus the accrual ratio), as well as note the ramifications of the company issuing new shares. One positive for Kindstar Globalgene Technology shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. As a result, some shareholders may be looking for stronger cash conversion in the current year.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, Kindstar Globalgene Technology increased the number of shares on issue by 8.9% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Kindstar Globalgene Technology's historical EPS growth by clicking on this link.

How Is Dilution Impacting Kindstar Globalgene Technology's Earnings Per Share (EPS)?

Three years ago, Kindstar Globalgene Technology lost money. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, if Kindstar Globalgene Technology's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

How Do Unusual Items Influence Profit?

Unfortunately (in the short term) Kindstar Globalgene Technology saw its profit reduced by unusual items worth CN¥25m. In the case where this was a non-cash charge it would have made it easier to have high cash conversion, so it's surprising that the accrual ratio tells a different story. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. In the twelve months to June 2022, Kindstar Globalgene Technology had a big unusual items expense. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Our Take On Kindstar Globalgene Technology's Profit Performance

In conclusion, Kindstar Globalgene Technology's accrual ratio suggests that its statutory earnings are not backed by cash flow; but the fact unusual items actually weighed on profit may create upside if those unusual items to not recur. And the dilution means that per-share results are weaker than the bottom line might imply. After taking into account all the aforementioned observations we think that Kindstar Globalgene Technology's profits probably give a generous impression of its sustainable level of profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, Kindstar Globalgene Technology has 2 warning signs (and 1 which can't be ignored) we think you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.