There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether Brii Biosciences (HKG:2137) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Brii Biosciences

Does Brii Biosciences Have A Long Cash Runway?

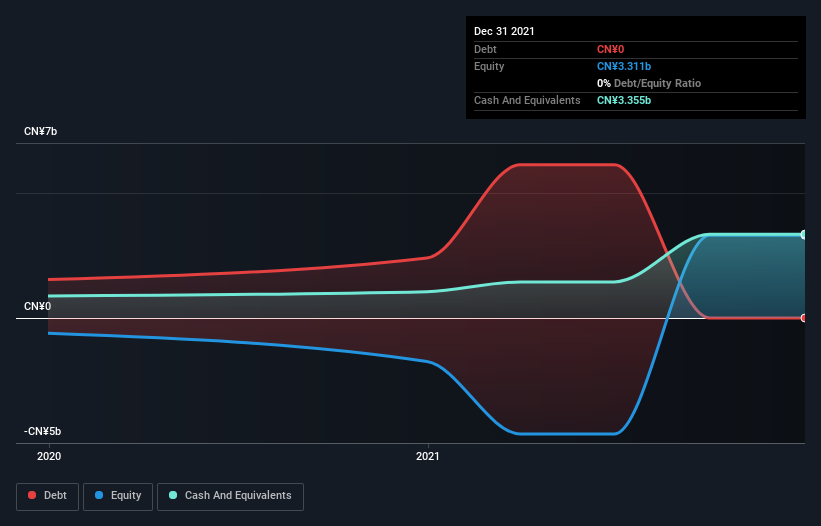

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at December 2021, Brii Biosciences had cash of CN¥3.4b and no debt. In the last year, its cash burn was CN¥880m. That means it had a cash runway of about 3.8 years as of December 2021. There's no doubt that this is a reassuringly long runway. Importantly, if we extrapolate recent cash burn trends, the cash runway would be noticeably longer. Depicted below, you can see how its cash holdings have changed over time.

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at December 2021, Brii Biosciences had cash of CN¥3.4b and no debt. In the last year, its cash burn was CN¥880m. That means it had a cash runway of about 3.8 years as of December 2021. There's no doubt that this is a reassuringly long runway. Importantly, if we extrapolate recent cash burn trends, the cash runway would be noticeably longer. Depicted below, you can see how its cash holdings have changed over time.

SEHK:2137 Debt to Equity History August 20th 2022

SEHK:2137 Debt to Equity History August 20th 2022How Is Brii Biosciences' Cash Burn Changing Over Time?

Although Brii Biosciences reported revenue of CN¥93m last year, it didn't actually have any revenue from operations. To us, that makes it a pre-revenue company, so we'll look to its cash burn trajectory as an assessment of its cash burn situation. In fact, it ramped its spending strongly over the last year, increasing cash burn by 118%. It's fair to say that sort of rate of increase cannot be maintained for very long, without putting pressure on the balance sheet. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Brii Biosciences Raise More Cash Easily?

While Brii Biosciences does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of CN¥5.1b, Brii Biosciences' CN¥880m in cash burn equates to about 17% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About Brii Biosciences' Cash Burn?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Brii Biosciences' cash runway was relatively promising. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. An in-depth examination of risks revealed 1 warning sign for Brii Biosciences that readers should think about before committing capital to this stock.

Of course Brii Biosciences may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.