Suzhou HYC Technology Co.,Ltd. (SHSE:688001) shareholders will doubtless be very grateful to see the share price up 76% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 30% in the last three years, falling well short of the market return.

While the stock has risen 11% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Suzhou HYC TechnologyLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate three years of share price decline, Suzhou HYC TechnologyLtd actually saw its earnings per share (EPS) improve by 3.1% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. Looking to other metrics might better explain the share price change.

The modest 0.5% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 23% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Suzhou HYC TechnologyLtd more closely, as sometimes stocks fall unfairly. This could present an opportunity.

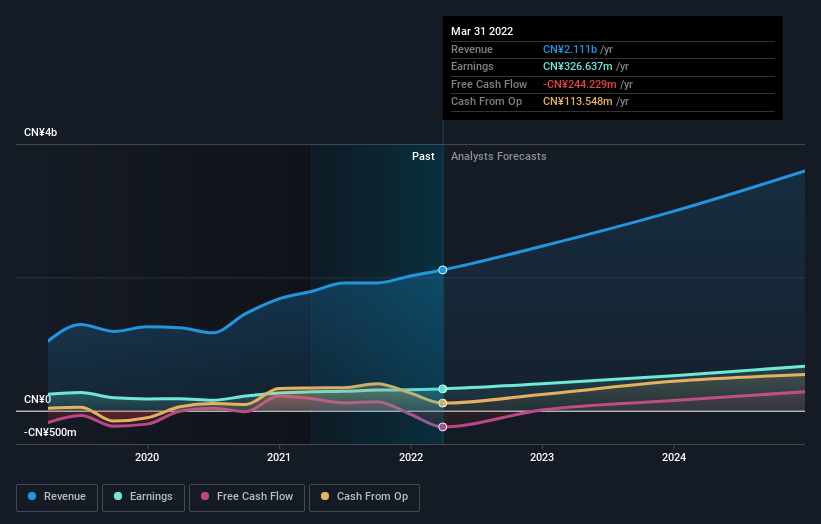

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

SHSE:688001 Earnings and Revenue Growth August 18th 2022

SHSE:688001 Earnings and Revenue Growth August 18th 2022We know that Suzhou HYC TechnologyLtd has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Suzhou HYC TechnologyLtd will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that Suzhou HYC TechnologyLtd rewarded shareholders with a total shareholder return of 1.2% over the last year. And yes, that does include the dividend. This recent result is much better than the 9% drop suffered by shareholders each year (on average) over the last three. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Suzhou HYC TechnologyLtd (at least 2 which can't be ignored) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.