The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But in contrast you can make much more than 100% if the company does well. To wit, the Viva China Holdings Limited (HKG:8032) share price has flown 153% in the last three years. How nice for those who held the stock! On top of that, the share price is up 36% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

The past week has proven to be lucrative for Viva China Holdings investors, so let's see if fundamentals drove the company's three-year performance.

Check out our latest analysis for Viva China Holdings

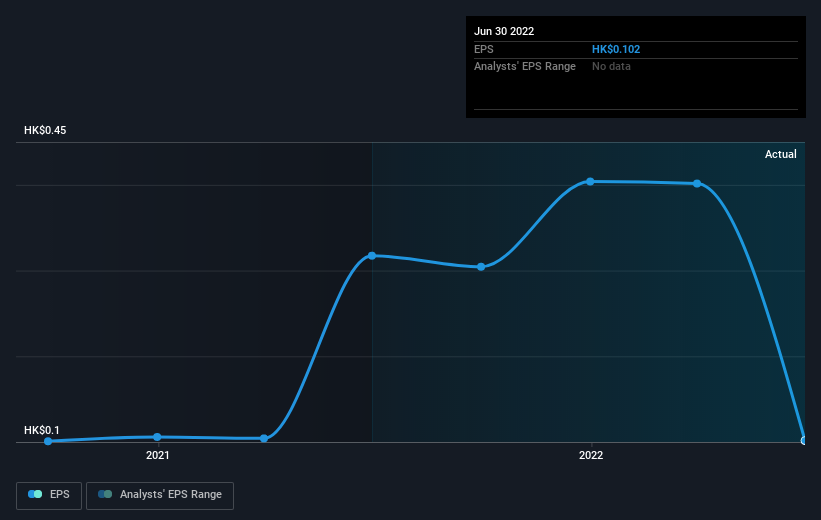

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During three years of share price growth, Viva China Holdings achieved compound earnings per share growth of 13% per year. This EPS growth is lower than the 36% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did three years ago. It is quite common to see investors become enamoured with a business, after a few years of solid progress.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

SEHK:8032 Earnings Per Share Growth August 18th 2022

SEHK:8032 Earnings Per Share Growth August 18th 2022We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Viva China Holdings the TSR over the last 3 years was 192%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

While it's certainly disappointing to see that Viva China Holdings shares lost 15% throughout the year, that wasn't as bad as the market loss of 17%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 22% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Viva China Holdings (1 doesn't sit too well with us!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.