It's normal to be annoyed when stock you own has a declining share price. But sometimes a share price fall can have more to do with market conditions than the performance of the specific business. The Postal Savings Bank of China Co., Ltd. (HKG:1658) is down 14% over a year, but the total shareholder return is -10% once you include the dividend. And that total return actually beats the market decline of 21%. On the other hand, the stock is actually up 9.5% over three years. In the last ninety days we've seen the share price slide 16%.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Postal Savings Bank of China

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Postal Savings Bank of China share price fell, it actually saw its earnings per share (EPS) improve by 12%. Of course, the situation might betray previous over-optimism about growth.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

Postal Savings Bank of China's dividend seems healthy to us, so we doubt that the yield is a concern for the market. The revenue trend doesn't seem to explain why the share price is down. Unless, of course, the market was expecting a revenue uptick.

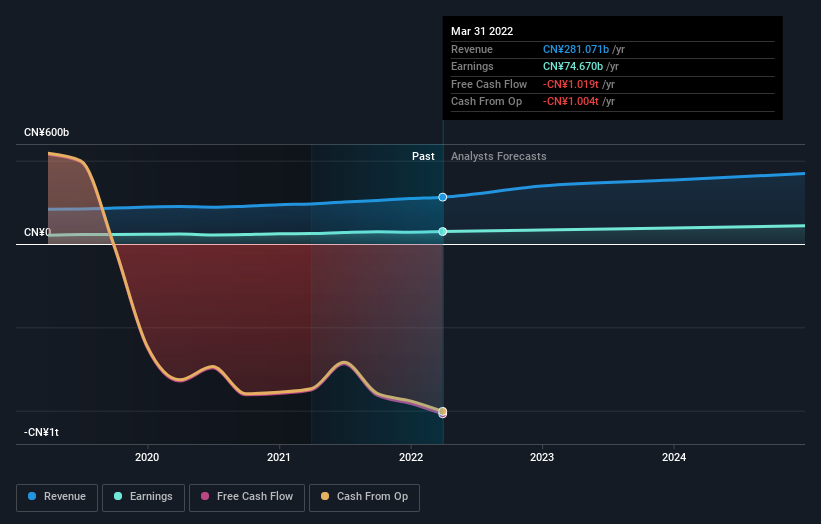

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

SEHK:1658 Earnings and Revenue Growth August 12th 2022

SEHK:1658 Earnings and Revenue Growth August 12th 2022Postal Savings Bank of China is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Postal Savings Bank of China in this interactive graph of future profit estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Postal Savings Bank of China, it has a TSR of -10% for the last 1 year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While it's never nice to take a loss, Postal Savings Bank of China shareholders can take comfort that , including dividends,their trailing twelve month loss of 10% wasn't as bad as the market loss of around 21%. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Postal Savings Bank of China , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.