For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Grand Pharmaceutical Group (HKG:512), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Grand Pharmaceutical Group

Grand Pharmaceutical Group's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Grand Pharmaceutical Group's EPS has grown 35% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

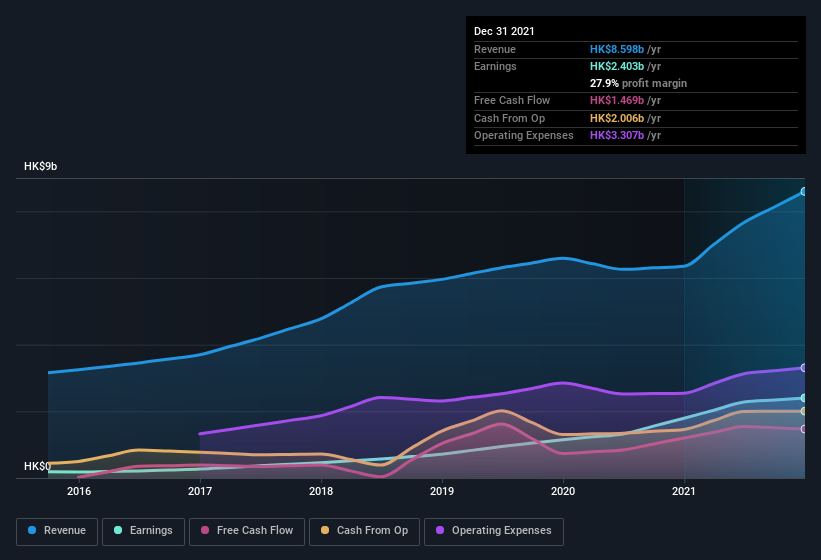

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the revenue front, Grand Pharmaceutical Group has done well over the past year, growing revenue by 35% to HK$8.6b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

SEHK:512 Earnings and Revenue History August 9th 2022

SEHK:512 Earnings and Revenue History August 9th 2022The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Grand Pharmaceutical Group's future EPS 100% free.

Are Grand Pharmaceutical Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the real excitement comes from the HK$711k that Executive Director Zhanqi Niu spent buying shares (at an average price of about HK$4.10). Strong buying like that could be a sign of opportunity.

On top of the insider buying, we can also see that Grand Pharmaceutical Group insiders own a large chunk of the company. In fact, they own 49% of the shares, making insiders a very influential shareholder group. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. This insider holding amounts to That level of investment from insiders is nothing to sneeze at.

Should You Add Grand Pharmaceutical Group To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Grand Pharmaceutical Group's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Grand Pharmaceutical Group that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Grand Pharmaceutical Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.