Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. For example, after five long years the Jinneng Science&Techology Co.,Ltd (SHSE:603113) share price is a whole 61% lower. We certainly feel for shareholders who bought near the top. We also note that the stock has performed poorly over the last year, with the share price down 46%. Even worse, it's down 17% in about a month, which isn't fun at all.

With the stock having lost 4.6% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Jinneng Science&TechologyLtd

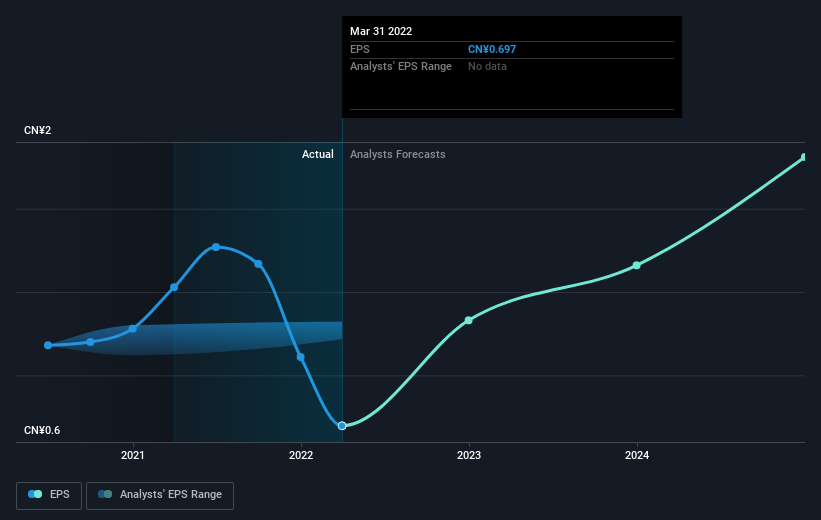

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Looking back five years, both Jinneng Science&TechologyLtd's share price and EPS declined; the latter at a rate of 8.6% per year. This reduction in EPS is less than the 17% annual reduction in the share price. This implies that the market was previously too optimistic about the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

SHSE:603113 Earnings Per Share Growth August 3rd 2022

SHSE:603113 Earnings Per Share Growth August 3rd 2022Dive deeper into Jinneng Science&TechologyLtd's key metrics by checking this interactive graph of Jinneng Science&TechologyLtd's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Jinneng Science&TechologyLtd the TSR over the last 5 years was -57%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market lost about 11% in the twelve months, Jinneng Science&TechologyLtd shareholders did even worse, losing 44% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Jinneng Science&TechologyLtd .

We will like Jinneng Science&TechologyLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.