Statistically speaking, long term investing is a profitable endeavour. But no-one is immune from buying too high. For example the Geo-Jade Petroleum Corporation (SHSE:600759) share price dropped 53% over five years. That's not a lot of fun for true believers. The last week also saw the share price slip down another 8.5%.

With the stock having lost 8.5% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Geo-Jade Petroleum

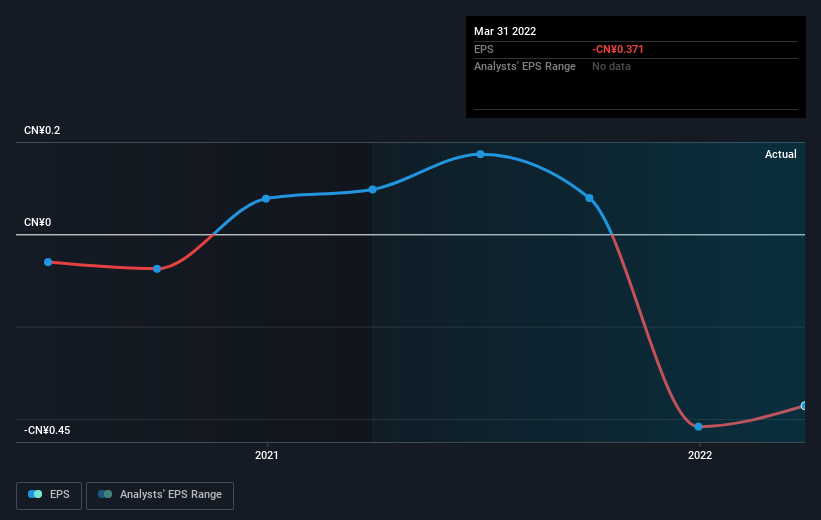

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

In the last half decade Geo-Jade Petroleum saw its share price fall as its EPS declined below zero. This was, in part, due to extraordinary items impacting earnings. At present it's hard to make valid comparisons between EPS and the share price. But we would generally expect a lower price, given the situation.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

SHSE:600759 Earnings Per Share Growth August 3rd 2022

SHSE:600759 Earnings Per Share Growth August 3rd 2022Dive deeper into Geo-Jade Petroleum's key metrics by checking this interactive graph of Geo-Jade Petroleum's earnings, revenue and cash flow.

A Different Perspective

While it's never nice to take a loss, Geo-Jade Petroleum shareholders can take comfort that their trailing twelve month loss of 1.7% wasn't as bad as the market loss of around 7.5%. Of far more concern is the 9% p.a. loss served to shareholders over the last five years. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Geo-Jade Petroleum has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.