Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Jiangsu Guomao Reducer (SHSE:603915). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Jiangsu Guomao Reducer

Jiangsu Guomao Reducer's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years Jiangsu Guomao Reducer grew its EPS by 16% per year. That's a pretty good rate, if the company can sustain it.

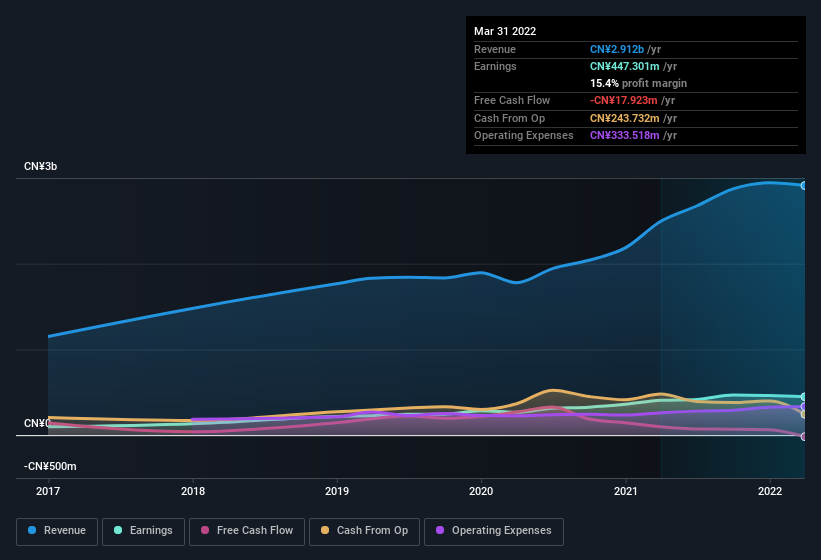

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the revenue front, Jiangsu Guomao Reducer has done well over the past year, growing revenue by 17% to CN¥2.9b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

SHSE:603915 Earnings and Revenue History August 1st 2022

SHSE:603915 Earnings and Revenue History August 1st 2022You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Jiangsu Guomao Reducer's future profits.

Are Jiangsu Guomao Reducer Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Jiangsu Guomao Reducer shares worth a considerable sum. We note that their impressive stake in the company is worth CN¥3.1b. That equates to 21% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Should You Add Jiangsu Guomao Reducer To Your Watchlist?

One positive for Jiangsu Guomao Reducer is that it is growing EPS. That's nice to see. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. These two factors are a huge highlight for the company which should be a strong contender your watchlists. You should always think about risks though. Case in point, we've spotted 3 warning signs for Jiangsu Guomao Reducer you should be aware of, and 1 of them doesn't sit too well with us.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.