As every investor would know, you don't hit a homerun every time you swing. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. We wouldn't blame Jacobio Pharmaceuticals Group Co., Ltd. (HKG:1167) shareholders if they were still in shock after the stock dropped like a lead balloon, down 77% in just one year. A loss like this is a stark reminder that portfolio diversification is important. Jacobio Pharmaceuticals Group may have better days ahead, of course; we've only looked at a one year period. Shareholders have had an even rougher run lately, with the share price down 46% in the last 90 days.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Jacobio Pharmaceuticals Group

Because Jacobio Pharmaceuticals Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Jacobio Pharmaceuticals Group's revenue didn't grow at all in the last year. In fact, it fell 69%. That looks like a train-wreck result to investors far and wide. The market didn't mess around, sending shares down the garbage shute. (Or down 77% to be specific). This kind of performance makes us wary, and usually gives us reason to forget about a stock. A healthy aversion to bagholding (holding potentially worthless stocks) sees many shareholders avoid buying shares like this, rightly or wrongly.

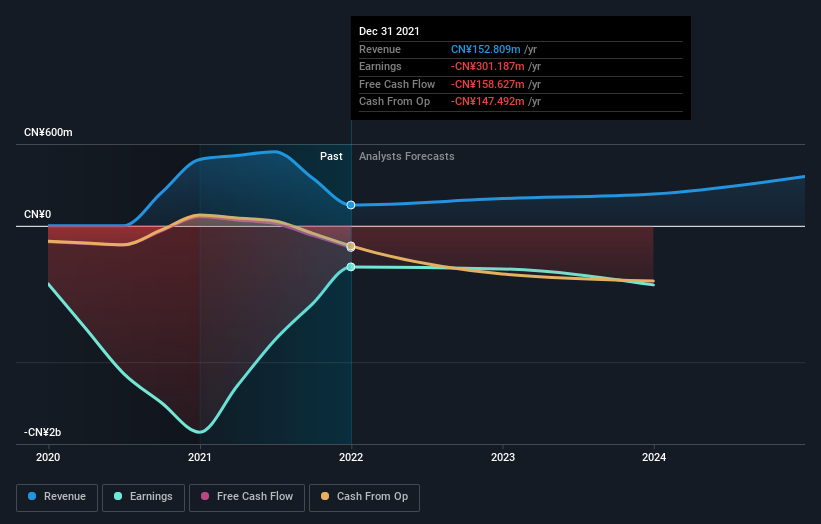

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

SEHK:1167 Earnings and Revenue Growth July 29th 2022

SEHK:1167 Earnings and Revenue Growth July 29th 2022We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Jacobio Pharmaceuticals Group shareholders are down 77% for the year, even worse than the market loss of 15%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 46%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with Jacobio Pharmaceuticals Group (including 1 which is significant) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.