This month, we saw the Suncity Group Holdings Limited (HKG:1383) up an impressive 288%. But that is meagre solace in the face of the shocking decline over three years. Indeed, the share price is down a whopping 85% in the last three years. So it's about time shareholders saw some gains. Of course the real question is whether the business can sustain a turnaround. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

The recent uptick of 78% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

View our latest analysis for Suncity Group Holdings

Because Suncity Group Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, Suncity Group Holdings' revenue dropped 65% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 23%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

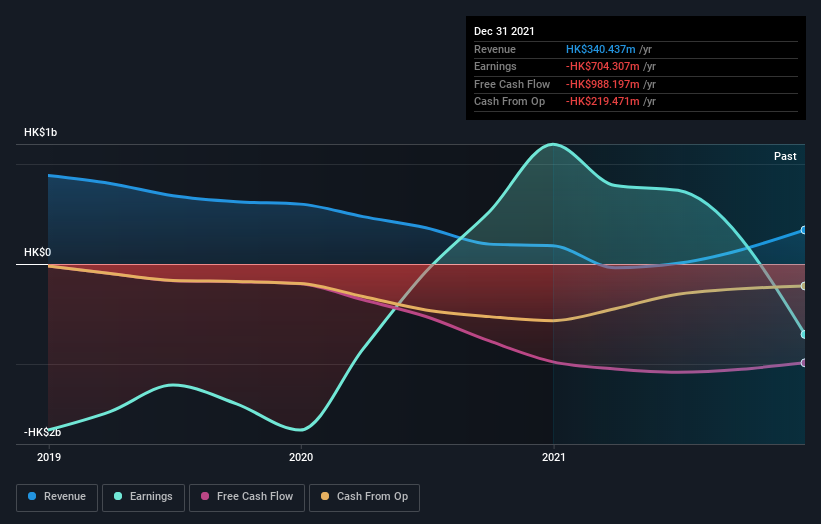

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

SEHK:1383 Earnings and Revenue Growth July 16th 2022

SEHK:1383 Earnings and Revenue Growth July 16th 2022You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that Suncity Group Holdings shareholders are down 48% for the year. Unfortunately, that's worse than the broader market decline of 21%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

But note: Suncity Group Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.