Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term Haitong Unitrust International Financial Leasing Co., Ltd. (HKG:1905) shareholders, since the share price is down 54% in the last three years, falling well short of the market decline of around 2.7%. And over the last year the share price fell 40%, so we doubt many shareholders are delighted.

Since Haitong Unitrust International Financial Leasing has shed CN¥576m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Haitong Unitrust International Financial Leasing

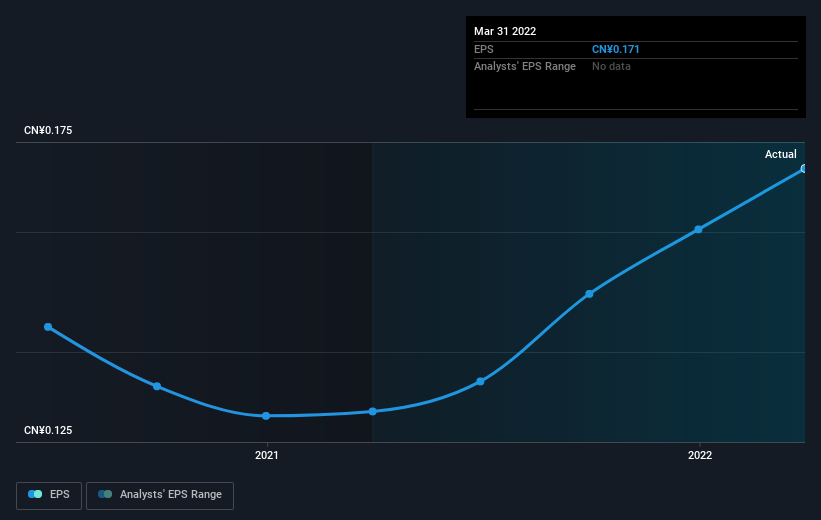

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Haitong Unitrust International Financial Leasing saw its EPS decline at a compound rate of 2.2% per year, over the last three years. This reduction in EPS is slower than the 23% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. This increased caution is also evident in the rather low P/E ratio, which is sitting at 3.97.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

SEHK:1905 Earnings Per Share Growth July 11th 2022

SEHK:1905 Earnings Per Share Growth July 11th 2022Dive deeper into Haitong Unitrust International Financial Leasing's key metrics by checking this interactive graph of Haitong Unitrust International Financial Leasing's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Haitong Unitrust International Financial Leasing, it has a TSR of -43% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

The last twelve months weren't great for Haitong Unitrust International Financial Leasing shares, which performed worse than the market, costing holders 34%, including dividends. Meanwhile, the broader market slid about 16%, likely weighing on the stock. The three-year loss of 13% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Haitong Unitrust International Financial Leasing better, we need to consider many other factors. Take risks, for example - Haitong Unitrust International Financial Leasing has 2 warning signs (and 1 which is potentially serious) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.