As every investor would know, you don't hit a homerun every time you swing. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. So we hope that those who held KWG Living Group Holdings Limited (HKG:3913) during the last year don't lose the lesson, in addition to the 76% hit to the value of their shares. A loss like this is a stark reminder that portfolio diversification is important. Because KWG Living Group Holdings hasn't been listed for many years, the market is still learning about how the business performs. The falls have accelerated recently, with the share price down 37% in the last three months.

With the stock having lost 9.2% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for KWG Living Group Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the KWG Living Group Holdings share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

We don't see any weakness in the KWG Living Group Holdings' dividend so the steady payout can't really explain the share price drop. The revenue trend doesn't seem to explain why the share price is down. Of course, it could simply be that it simply fell short of the market consensus expectations.

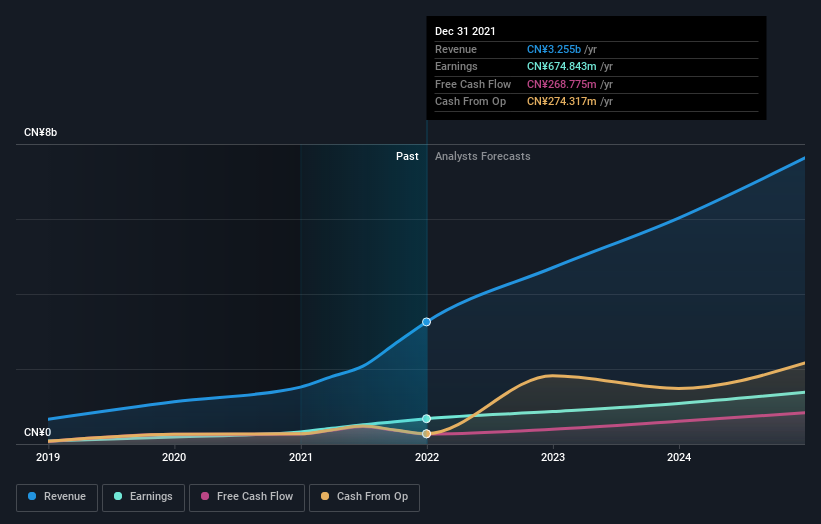

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

SEHK:3913 Earnings and Revenue Growth July 6th 2022

SEHK:3913 Earnings and Revenue Growth July 6th 2022We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on KWG Living Group Holdings

A Different Perspective

We doubt KWG Living Group Holdings shareholders are happy with the loss of 74% over twelve months (even including dividends). That falls short of the market, which lost 17%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 37%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand KWG Living Group Holdings better, we need to consider many other factors. Take risks, for example - KWG Living Group Holdings has 3 warning signs (and 1 which is concerning) we think you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.