データなし

コード銘柄名

現在値変化額変化率出来高売買代金始値前日終値高値安値時価総額浮動株時価株式総数浮動株5日変化率10日変化率20日変化率60日変化率120日変化率250日変化率年初来配当利回売買回転率直近PER前年PER振幅業種

データなし

速報 | NYSEのオーダー不均衡、売りサイドで66361.0株

速報 | 買い側に178502株のNYSE注文不均衡

センプラなどの株を買う内部者

金曜日に米国株式市場は高値で終了しましたが、注目すべきインサイダートレードがいくつかありました。企業幹部が株式を購入する場合は、企業の見通しに対する信懇智能を示すか、株式市場の見通しを良くとらえているとみなすことができます。

ディレクターのリチャード・マークがセンプラ(SRE)の株式を取得

センプラ エナジー(SRE.US)、取締役が15.01万ドルで普通株1,925株を取得

米国証券取引委員会(SEC)が5月17日に開示した文書によると、$センプラ エナジー(SRE.US)$の取締役MARK RICHARD Jは、5月17日に1株平均77.97ドルで普通株1,925株を取得、合計額は約15.01万ドル。出所:SEC 株式保有報告書とは何かSECは上場会社の内部者 (インサイダー) に対し、株式取引や保有状況の公開を義務付けている。内部者 (取締役や執行役などの役員、株

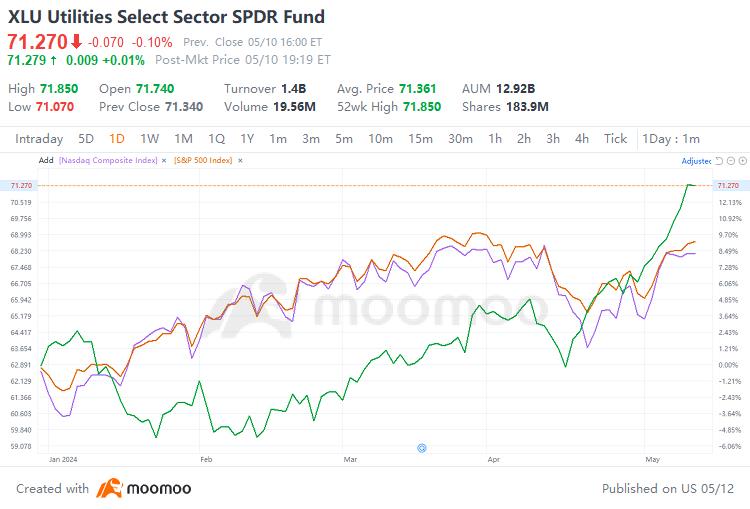

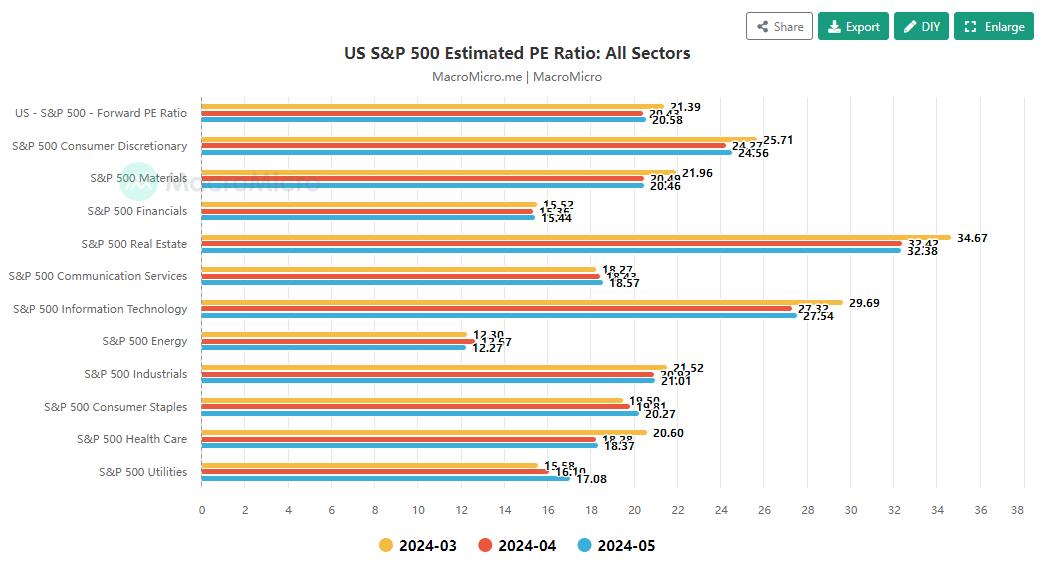

過去3ヶ月でユーティリティーは急騰していますが、現在はオーバーボウトシグナルを発しています。

10baggerbamm : all these so-called experts they're late to the game as usual typically they downgrade at a bottom and upgrade at a near top. I was buying utsl pounding the table telling people to buy it at $14 and hit 29 this past Friday. now I'm buying DRN..ETF, 12 months this is going to be north of $20. for the most undervalued individual stock equity in the US marketplace...its KNDI. TRADING AT 1.6 TIMES REVENUE IT'S RIDICULOUS THE COMPANY IS NOW PROFITABLE THE COMPANY BOUGHT BACK 30 MILLION WORTH OF STOCK THE FIRST QUARTER IN THE OPEN MARKET 4TH QUARTER LAST YEAR THE COMPANY COMPLETED ITS US DISTRIBUTION NETWORK THE US MARKET SHARE GREW OVER 50% LAST QUARTER REVENUE GROWTH. the stock's been over $20 in the past when it was nowhere near as well run and able to execute like they are today.. this company should be trading at a minimum 5 to 10 times revenues right now which would put this stock between 10 and 20 and once people realize what it is they just got to deal with the NFL the right to use their marketing and they're building EVS tagged with all the NFL teams it just was announced this past weekend they're growing their executing and rather than Chase yesterday's hero nothing wrong with Microsoft I own it I've owned it 20 years but I'm not going to get tenfold price increase in Microsoft in 2 years or one year and I believe I will in kndi.