Track the latest developments in north-south funding

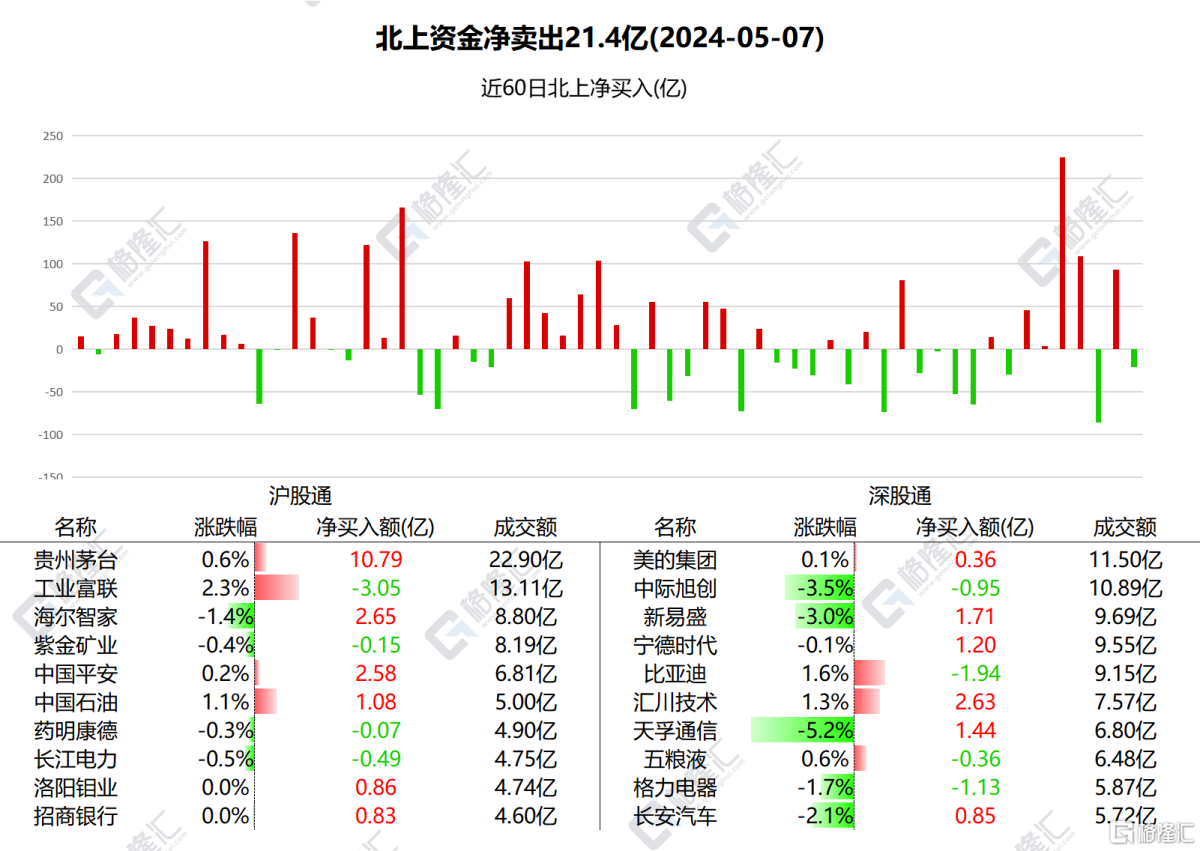

The net sale of A-shares by Beijing Capital today was 2.14 billion yuan. Among them, Shanghai Stock Connect had net sales of 351 million yuan and Shenzhen Stock Connect had net sales of 1,789 million yuan.

IFF, BYD, and Gree Electric received net sales of 305 million yuan, 194 million yuan, and 113 million yuan respectively; Kweichow Moutai bucked the trend and received a net purchase of 1,079 million yuan. According to statistics, the capital from North China has significantly increased its holdings in Kweichow Moutai for 2 consecutive days, totaling 4.14 billion yuan.

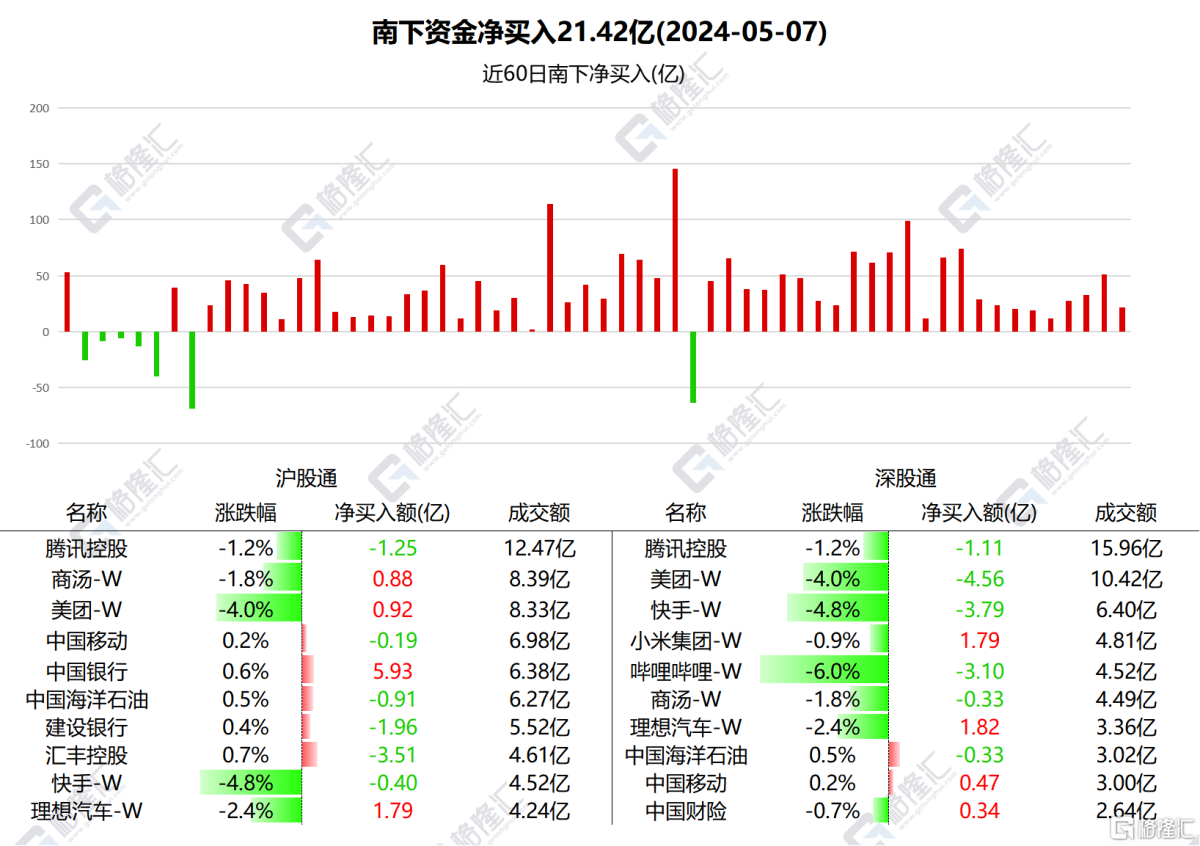

Southwest Capital made a net purchase of HK$2,142 billion in Hong Kong stocks today. Among them, Hong Kong Stock Connect (Shanghai) made net purchases of HK$1,551 million, and Hong Kong Stock Connect (Shenzhen) made net purchases of HK$591 million.

Net purchases of Bank of China at 593 million, Ideal Auto at 360 million, and Xiaomi at 178 million; net sales of Kuaishou at 419 million, Meituan at 363 million, HSBC Holdings at 351 million, Bilibili at 309 million, Tencent at 235 million, CCB at 195 million, and CNOOC at 123 million.

Nanshui focuses on individual stocks

IFFToday's increase was 2.26%. Recently, IFF disclosed its quarterly report. Net profit for the first quarter was 4.18 billion yuan, an increase of 33.77% over the previous year. During the reporting period, the company's cloud computing business revenue accounted for nearly 50% of total revenue; AI servers accounted for nearly 40% of total server revenue, and AI server revenue nearly tripled year-on-year, showing a nearly double-digit increase; in addition, generative AI servers increased nearly threefold year-on-year, and showed a double-digit month-on-month increase.

Kweichow MoutaiToday's increase of 0.56% was a net purchase for the second day in a row. In the first quarter of 2024, Kweichow Moutai's total revenue was 46.485 billion yuan, up 18.04% year on year; net profit was 24.065 billion yuan, up 15.73% year on year. In addition, Kweichow Moutai issued a personnel change announcement on the evening of April 29 recommending Zhang Deqin as the new chairman. The appointment of this senior expert in the wine industry has further strengthened foreign investors' confidence in the company's future development.

Beishui focuses on individual stocks

Bank of ChinaToday's increase was 0.56%. According to enterprise investigation data, the Bank of China has obtained a new design patent. The patent name is “graphical user interface for product monitoring and alerting on a screen panel”. The patent application number is CN202330474787.5, and the authorization date is May 7, 2024.

The ideal carIt's down 2.38% today. In the 18th week of 2024 (4.29-5.5), Ideal Auto sold 530,000 units per week. During the first sale period from April 18 to May 5, the cumulative order for the new Ideal L6 has exceeded 41,000 units. In second place is Wenjie, with weekly sales of 0.48,000 vehicles, followed by Extreme Krypton, NIO, Deep Blue, and Zero Run.