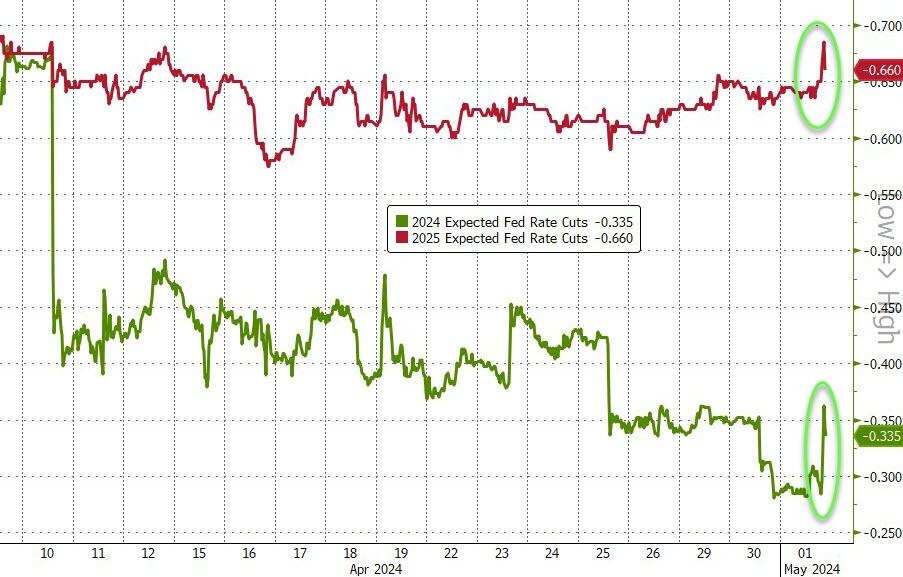

The monetary policy resolution announced by the Federal Reserve this Wednesday kept interest rates high and slowed the pace of quantitative austerity (QT) as expected by the market, cutting the downsizing of US Treasury bonds by more than half of what was expected. Although the resolution statement warned that there has been no progress in the recent decline in inflation, Federal Reserve Chairman Powell acted as the “savior” of US debt.

Before the Federal Reserve's resolution day arrived, there was strong bearishness in the bond market. Market participants expected Powell to release his hawkish stance, reaffirm that he is not in a hurry to cut interest rates, and acknowledge the recent deterioration in inflation prospects. Meanwhile, at the press conference after this meeting, Powell made it clear that the next interest rate action is “impossible” to raise interest rates. The review said that Powell's statement to rule out the possibility of interest rate hikes has allayed investors' concerns about the stickiness of inflation.

According to commentators, the basic message conveyed by the Federal Reserve is that interest rate cuts have been postponed, but they have not deviated from the right track of interest rate cuts. The Federal Reserve may not have enough confidence in cutting interest rates, but it has not considered raising interest rates. The Federal Reserve's resolution statement is laid-back; plans to slow downsizing are beneficial to the bond market. Powell's press conference showed that he believes monetary policy is restrictive. If policies are restrictive, then we should be more concerned about the risk of declining economic growth than the risk of rising inflation.

Before the announcement of the Federal Reserve's major decision, investors in the bond market and stock market restrained economic data such as “small non-farmers” ADP private sector employment and the US Treasury's refinancing bond scale in line with expectations. In April, the price of US Treasury bonds, which had the worst performance in 14 months, rebounded and yields fell. The two major stock indicators, the P&NASDAQ, continued to decline, and the fluctuations were moderated from Tuesday.

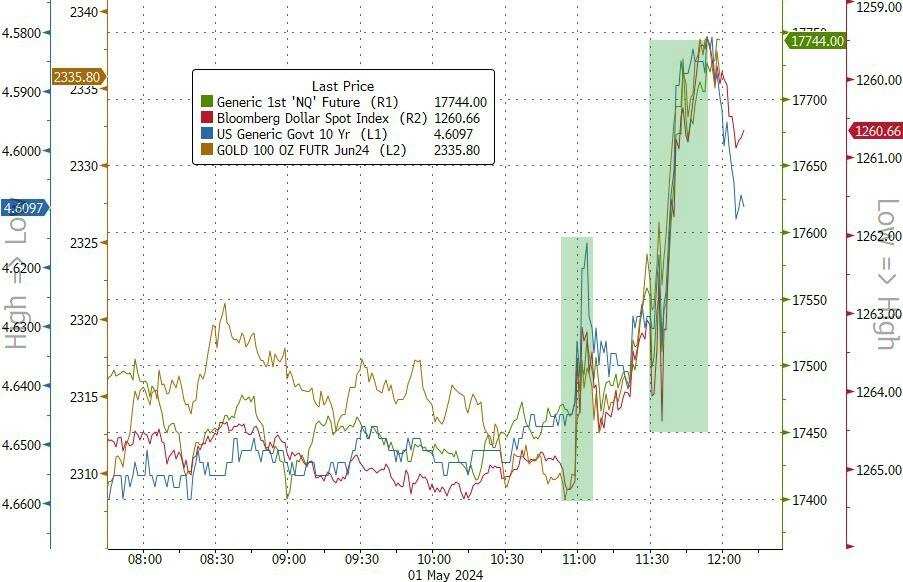

After the Federal Reserve announced its resolution, the S&P and NASDAQ indices turned up, and the price of US bonds jumped. During Powell's speech, the three major US stock indexes increased their gains to more than 1%, and US bond yields jumped at an accelerated pace. Interest rate sensitive two-year US Treasury yields fell below 5.0%, down more than 10 basis points from the five-month high created after rising above 5.0% on Tuesday. However, US stocks failed to maintain their gains. After Powell's press conference, the S&P and NASDAQ returned to their decline, and the Dow returned to most of their gains. The market was suppressed by some technology stocks such as Nvidia.

Financial reports clearly affected leading stocks in the industry: AMD, which failed to meet high market expectations this year, fell 10%; revenue for the third fiscal quarter fell by more than 10%, falling by more than 10%, and fell nearly 19% in the intraday period; same-store sales unexpectedly declined in the second fiscal quarter and Starbucks, which lowered the 2024 fiscal year guidelines, fell nearly 18% in the intraday; profit in the first quarter exceeded expectations; Amazon's intraday increase of 6% in the cloud business accelerated growth in the two quarters, supporting the Dow's rebound; revenue in the first quarter was higher than expected and rose by nearly 6% during the whole year. The profit-guided Pfizer rose more than 7% in the intraday period. China Securities generally rebounded, and NIO Auto surged more than 10% in April, when delivery volume exceeded expectations and doubled strongly over the same period last year.

On the foreign exchange market side, after Powell's speech, the US dollar index, which had reached a five-month high in the Asian market two weeks ago, rapidly declined, and non-US currencies generally rose. However, the yen suddenly experienced a huge shock after closing. At one point, it rebounded more than 3% from its intraday low. Following Monday, which is suspected to have interfered by the Japanese government, it surged more than 3% intraday on the second day of this week. The dollar almost fell below 153.00 against the yen, far from the high level since 1990, which broke through 160 before Monday's sharp fall.

Commodity performance varied. After Powell's speech, as the dollar and US bond yields accelerated, gold, which had plummeted on Tuesday, rebounded at an accelerated pace, and the intraday gains of both spot gold and New York futures expanded to more than 1%. While Israel and Hamas were in cease-fire negotiations, US oil inventories unexpectedly soared, leading to poor demand. The decline in international crude oil accelerated. US oil fell below the 80 US dollar mark, and both hit new lows since early March. After a lapse of two weeks, it fell more than 3% in one day, the worst single-day performance since Saudi Arabia cut crude oil prices in excess of expectations almost four months ago. The US Department of Energy announced that US EIA crude oil inventories increased by more than 7.2 million barrels month-on-month last week, the biggest weekly increase since February. Last week, EIA gasoline inventories increased by more than 300,000 barrels, while analysts all expected a drop of one million barrels.

The S&P Index fell two times in a row, and the three major US stock indexes rose more than 1% after Powell's speech, and China probably rebounded, and closed up nearly 12% after NIO announced delivery volumes

The three major US stock indexes have had mixed ups and downs since the opening of the market, and they rose together in midday trading. The S&P 500 index and the Nasdaq Composite opened lower. At a new low in midday trading, S&P fell more than 0.4%, and the NASDAQ fell more than 0.6%. After Powell announced its resolution in midday trading, they all turned up. The rise accelerated during Powell's speech. At a new high, the NASDAQ rose 1.7% and S&P rose 1.2%. The high-opening Dow Jones Industrial Average only turned down in the short term at the beginning of the day, and gains also increased in midday trading. After Powell's speech, it rose more than 530 points and rose more than 1.4%.

After Powell's press conference at the end of the session, the three major indices fell, and the S&P and NASDAQ fell again. In the end, only the Dow closed higher, up 87.37 points, or 0.23%, to 37,903.29 points. For the time being, it fell close to 1.5% on Tuesday to its closing low since April 19. S&P closed down 0.34% to 5018.39 points, breaking its low since April 22, when it fell 1.57% on Tuesday. The NASDAQ, which fell about 2% on Tuesday, closed down 0.33% to 15605.48 points, and both fell for two consecutive days.

The tech-heavy Nasdaq 100 index closed down 0.7%, and both the Nasdaq index fell two days in a row to their lowest level since April 22. The Nasdaq Technology Market Capitalization Weighted Index (NDXTMC), which measures the performance of technology components in the Nasdaq 100 Index, closed down 1.15%, outperforming the market, falling three times in a row until April 22. The small-cap stock index Russell 2000, which is mainly value stocks, closed up 0.32%, outperforming the market, and bid farewell to the low since April 22 caused by a fall back on Tuesday.

Among the constituent stocks of the Dow, Johnson & Johnson led the way, with a rise of more than 4%, followed by Amazon and Boeing, which rose more than 2%. After Tuesday's earnings report surged 4.7%, and industrial giant 3M (MMM) rose 2% after being upgraded to overrated by J.P. Morgan Chase.

Among the major sectors of the S&P 500, a total of six closed down on Wednesday. Energy, which was hit by the sharp drop in crude oil, fell 1.6%, IT in which chip stocks such as Nvidia are located fell nearly 1.3%, and finance and non-essential consumer goods where Amazon is located fell slightly. Among the five sectors that closed higher, utilities rose more than 1.1%, and Meta's communications services rose more than 0.8%.

Including Microsoft, Apple, Nvidia, Google's parent company Alphabet, Amazon, Facebook's parent company Meta, and Tesla, the tech giants “Seven Sisters” had mixed ups and downs, with Nvidia leading the decline. Tesla closed down nearly 5.6% on Tuesday, closing down 1.8%, continuing to fall from the closing high since March 1, set by a 15% rebound on Monday.

Among the six major FAANMG technology stocks, Amazon, which published financial reports, rose nearly 6% and closed up 2.2% in midday trading. After falling back more than 3% on Tuesday, it began to approach the closing high since April 17 set on Monday; Meta closed up nearly 2.1%, rebounding after breaking the closing low since February 1 for two consecutive days; Microsoft, which fell to its closing low since January 12, closed up nearly 1.5% on Tuesday; Alphabet closed 0.6% and did not continue to fall below the historical closing level created by last Friday's rebound; Tuesday to January 24 Netflix, which has been low since then, closed up 0.2%; while Apple, which turned down at the end of the session, closed down 0.6% and continued to fall below its closing high since April 12, when it rebounded and refreshed on Monday.

Chip stocks generally outperformed the market. The Philadelphia Semiconductor Index and semiconductor industry ETF SOXX closed down about 3.5% and 3.4%, respectively, and fell two consecutive times until April 23. Among chip stocks, Nvidia fell nearly 6% near midday trading, closing down more than 3.9%; after announcing earnings, AMD fell nearly 10.3% near midday trading, and the decline narrowed slightly, closing down about 9%; Intel, which turned around at the end of the session, closed down 0.4%, falling for four consecutive days after announcing earnings last week; Arm fell 5.8%, and Broadcom dropped more than 4%. Micron Technology fell 2.8%, and TSMC US shares fell nearly 1.8% after closing; while Qualcomm announced its second-quarter earnings and results for the second quarter after closing more than 1% This season's guidance was higher than expected, and it rose 5% after the market.

Most AI concept stocks, which generally plummeted on Tuesday, rebounded. At the close, SoundHound.ai (SOUN) rose 3.8%, BigBear.ai (BBAI) rose 3.6%, Adobe (ADBE) rose 1.4%, Oracle (ORCL) rose nearly 0.8%, C3.ai (AI) rose 0.7%, and Palantir (PLTR) rose nearly 0.7%, while the ultra-microcomputer (SMCI), which published financial reports, fell about 18.5% in early trading and closed down 14%; known as “Little Nvidia”, Astera Labs (ALAB) sells data center interconnect chips ) fell 11.7%.

Popular Chinese securities generally rebounded. The Nasdaq Golden Dragon China Index (HXC) closed up nearly 0.6%, outperforming the market, and rebounded after falling more than 3% to stop rising for six consecutive days on Tuesday. China's general ETFs KWEB and CQQQ closed up nearly 0.4% and 0.5%, respectively. Among the new car builders, at the close of the market, NIO Auto rose nearly 11.7%, Ideal Auto rose nearly 0.3%, Xiaomi FAN rose 0.2%, while Xiaopeng Motors fell 0.1%. Among other individual stocks, at the close, JD rose more than 1%, Alibaba, Baidu, and Tencent fans rose nearly 0.9%, Station B rose 0.7%, NetEase rose 0.6%, and Pinduoduo fell nearly 0.6%.

Among the individual stocks that announced financial reports, Starbucks (SBUX) closed down 15.9% after earnings and revenue for the second quarter were lowered; pharmacy chain CVS Health (CVS), which had lower earnings than expected in the first quarter and lowered its full-year profit guidance, closed down 16.8%; beauty giant Estée Lauder (EL), whose profit guidance for the fourth quarter was lower than expected, closed down 13.2%; KFC (KHC), which had lower earnings and revenue expectations for the first quarter, closed down 6%; KFC's parent company, which had lower earnings and revenue expectations for the first quarter (YUM) closed down 4.2%.

Meanwhile, Pfizer (PFE), which had better-than-expected first-quarter results and raised annual guidance, closed up 6.1%; power infrastructure company Powell Industries (POWL), whose second-quarter revenue and profit were higher than expected, closed 18.9%; the regional bank New York Community Bank (NYCB) closed up 28.3% after losing $335 million in the first quarter but after the CEO said it had a clear profit path for the next two years; social media Pinterest (PINS), which had first-quarter revenue higher than expected, closed 21%.

In terms of European stocks, including the four largest economies in the Eurozone — Germany, France, Italy, and the West — many European stock markets were closed on Labor Day, and the pan-European stock index declined slightly for two consecutive days. The European Stoxx 600 index closed down 0.11% and continued to fall from its closing high since April 8, when it was refreshed for two consecutive days. British stocks, which fell slightly on Tuesday, continued to break away from the record closing level set for three consecutive days up to Monday.

Among individual stocks that announced financial reports, after announcing pre-tax adjusted losses for the first quarter expanded more than expected and nearly tripled year over year, London-listed luxury car manufacturer Aston Martin fell more than 12% in the intraday period, closing down nearly 6.8%; while the London-listed pharmaceutical company GlaxoSmithKline, which raised its annual profit guidelines, closed up 1.9%.

US Treasury yields fell by more than 10 basis points in the two-year period after Powell's speech to bid farewell to a five-month high

The yield on the US 10-year benchmark treasury bond rose 4.70% in early trading for European stocks and fell 4.64% in early trading. Powell said the next step was unlikely to quickly fall 4.60% after raising interest rates, falling below 4.58%, breaking the low level since April 23, falling about 10 basis points during the day, away from the high level since November 2, 2023, which was refreshed by 4.73% last Thursday. By the end of the bond market, it was about 4.63%, falling about 5 basis points during the day (4.6798% on Tuesday). Two rebounds and then retreated.

The 2-year US bond yield, which is more sensitive to interest rate prospects, was 5.04% in the European stock market, approaching the high level since November 14, 2023, which was refreshed after rising above 5.04% on Tuesday. After the opening of European stocks, US stocks continued to fall at 5.0% in early trading. After Powell denied raising interest rates again in the afternoon, it fell 4.93% to a new daily low, falling about 11 basis points during the day. By the end of the bond market, it was about 4.96%, down about 7 basis points during the day.

After Powell's speech, the US dollar index, which hit a new high in two weeks during the intraday period, accelerated its decline, and the yen soared more than 3% at the end of the session

The ICE dollar index (DXY), which tracks the exchange rate of a basket of six major currencies including the US dollar against the euro, approached 106.50 before the European stock market, breaking the intraday high level since April 16, reaching the high level since November 1, 2023 set after rising 106.50 on April 16. It rose 0.25% during the day and continued to decline thereafter. US stocks fell below 105.80 after the announcement of the Federal Reserve's decision. The decline in US stocks expanded rapidly after closing, falling below the daily low of 105.50, and falling more than 0.7% during the day.

By the end of the foreign exchange market on Wednesday, the US dollar index was above 105.60 and fell nearly 0.6% during the day; the Bloomberg US dollar spot index, which tracks the exchange rate of the US dollar against ten other currencies, fell nearly 0.2% during the day, falling to the same high level since April 16, which was refreshed on Tuesday. After the Federal Reserve announced its resolution, it fell more than 0.5% at the new low, and the US dollar index both fell after rebounding on Tuesday.

Among non-US currencies, the yen skyrocketed at the end of the session. The dollar surged to a new high of 158.00 against the European stock market. The US stock market rose more than 0.1% during the day, and the US stock market dived after closing. At one point, it reached 153.00 to 153.04, falling 3% during the day, falling more than 3.1% from the daily high. The foreign exchange market returned to the 154.30 line at the end of the session, and the intraday decline narrowed to 2.2%; EUR/USD fell below 1.0650 before the European stock market, breaking the low since April 23. The market had risen above 1.0730, close to breaking 1.0740 last Friday It hit a high level since April 11, and rose more than 0.6% during the day; GBP/USD hit a new daily high of 1.2550 in midday trading, rising nearly 0.5% during the day, and did not continue to fall below the high level since April 11, which was refreshed at 1.2570 on Monday.

The offshore renminbi (CNH) was as low as 7.2549 against the US dollar at the beginning of the Asian session, and continued to rise thereafter. US stocks rose to 7.2318 after the mid-day session, rising to 7.2318 after the mid-day session, rising to a high intraday high since 7.2177 on March 22, and rose 230 points during the day. At 4:59 Beijing time on May 2, the offshore RMB was 7.2341 yuan against the US dollar, up 207 points from the end of Tuesday's session in New York, and rebounded after falling back on Tuesday.

Bitcoin (BTC) reached a new daily high above $60,000 in early Asian trading, rising above $61,000 on some platforms. The overall decline was during the European and American trading session. US stocks fell below $56,800 in midday trading and fell below $56,600 on some platforms. They hit a two-month low since the end of February for two consecutive days, falling more than 4,000 US dollars and falling more than 7% from the daily high. After the Federal Reserve announced its decision, it narrowed its decline by more than half. At one point, it reached 59,500 thousand US dollars. At the close of trading, US stocks were at Above 57,000 US dollars, some platforms have fallen below 571,000 US dollars, down about 4% in the last 24 hours.

Crude oil fell more than 3%, the biggest drop in nearly four months, and fell to a seven-week low for three consecutive weeks

International crude oil futures were in decline throughout the day on Wednesday. US WTI crude oil fell below the $80 mark in early trading of US stocks. When US stocks hit a new intraday low since March 12 at noon, US oil was close to 78.80 US dollars, falling nearly 3.8% during the day. Brent crude oil fell to 83.30 US dollars, falling about 3.5% during the day.

In the end, crude oil closed down for three consecutive days. Following April 17, it also recorded the biggest daily decline since Saudi Arabia cut the price of official crude oil sold to Asia on January 8 in excess of expectations. WTI crude oil futures for June closed down $2.93, or more than 3.576%, to $79.00 per barrel; Brent crude oil futures for July closed down $2.89, or nearly 3.35%, to $83.44 per barrel, all breaking the closing low since March 12.

US gasoline and natural gas futures continued to fall sharply. NYMEX's June gasoline futures closed down about 4.2% to 2.5774 US dollars/gallon, falling for three days, breaking the closing low since March 8; NYMEX's June natural gas futures closed down more than 2.96% to 1.9320 US dollars/million British thermal units, falling two consecutive days to a low level since April 22.

Gold rebound futures rose more than 1% in the intraday period after breaking out of a four-week low.

London basic metals futures fell sharply on Wednesday. On Tuesday, which fell more than 4%, Lunxi closed down nearly 2%, leading the decline for two consecutive days. On the second day, it hit a three-week low, and lentong, zinc, and lun lead all fell for 2 consecutive days. Luntong closed below $9,900, continuing to bid farewell to the high since April 2022 created after breaking through $10,000 on Monday. Lunzine and lithium lead continued to fall from their high levels since March last year and November of last year, respectively. Lun Nickel, which had been rising for two days, and Lun Aluminum, which had been rising for three days, fell close to 1.9%, falling close to the high level set last Monday since September last year.

Gold turned higher in the intraday session on Wednesday. In the Asian market, New York gold futures fell to 2291.7 US dollars, falling nearly 0.5% during the day. Spot gold fell below 2,282 US dollars and fell about 0.2% during the day. Both hit intraday low levels since April 5 on the 2nd, then continued to recover, and European stocks rose to 2,300 US dollars intraday.

At the close, COMEX June gold futures closed up 0.35% to 2,311 US dollars/ounce, breaking away from the closing low since April 2, which was refreshed on Tuesday. They closed higher on the fourth day of the last five trading days, but due to a sharp drop of 2.3% on Monday, they will continue to decline this week.

After the Federal Reserve announced its resolution in midday trading of the US stock market, gold gains expanded rapidly. At the time of Powell's speech, futures were close to $2340.00, up nearly 1.6% from Tuesday's closing. Spot gold rose above $2,328, up more than 1.8% during the day.

Some gains were later recovered. At the close of the US stock market, spot gold was slightly higher at 2,310 US dollars, up about 1.1% during the day. Futures were above 2,320 US dollars, up about 0.9% during the day.