Financial giants have made a conspicuous bullish move on Chevron. Our analysis of options history for Chevron (NYSE:CVX) revealed 21 unusual trades.

Delving into the details, we found 52% of traders were bullish, while 38% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $485,809, and 12 were calls, valued at $379,972.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $185.0 for Chevron, spanning the last three months.

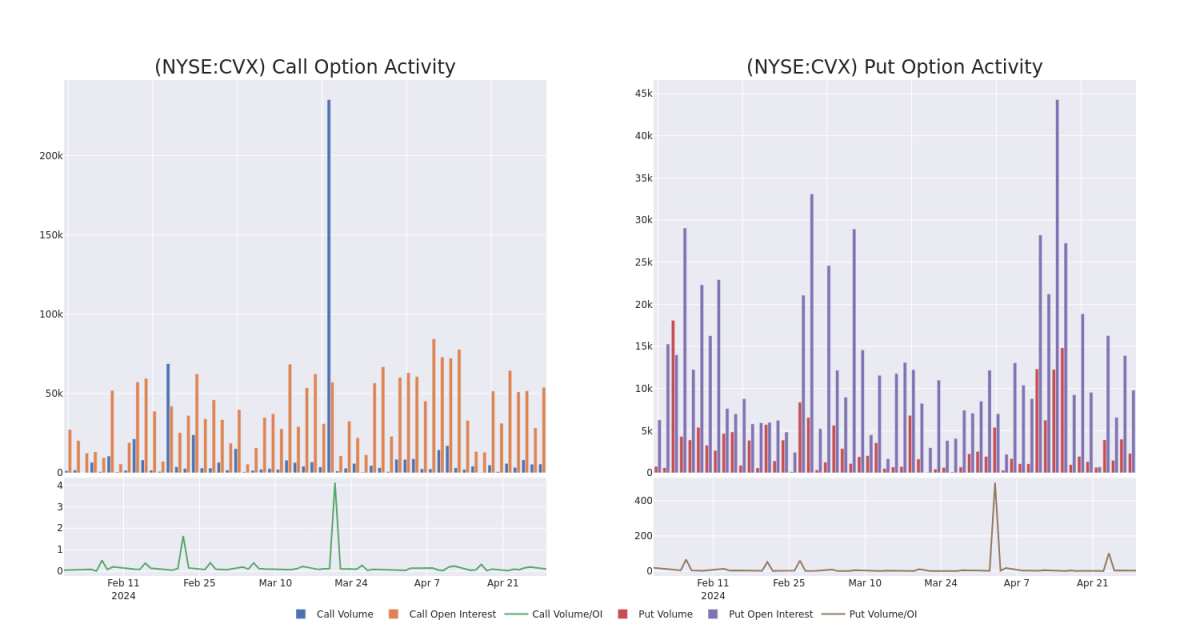

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Chevron options trades today is 3535.5 with a total volume of 7,812.00.

In terms of liquidity and interest, the mean open interest for Chevron options trades today is 3535.5 with a total volume of 7,812.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Chevron's big money trades within a strike price range of $100.0 to $185.0 over the last 30 days.

Chevron Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVX | PUT | TRADE | BULLISH | 05/17/24 | $3.2 | $3.15 | $3.15 | $165.00 | $126.0K | 816 | 468 |

| CVX | PUT | SWEEP | BULLISH | 05/17/24 | $20.95 | $20.55 | $20.55 | $185.00 | $90.4K | 3 | 0 |

| CVX | PUT | TRADE | BULLISH | 06/21/24 | $4.3 | $4.25 | $4.25 | $165.00 | $53.5K | 1.2K | 312 |

| CVX | PUT | SWEEP | BEARISH | 01/17/25 | $8.35 | $8.25 | $8.35 | $160.00 | $50.9K | 3.8K | 367 |

| CVX | CALL | SWEEP | BULLISH | 12/20/24 | $12.05 | $12.0 | $12.05 | $165.00 | $44.5K | 1.6K | 38 |

About Chevron

Chevron is an integrated energy company with exploration, production, and refining operations worldwide. It is the second-largest oil company in the United States with production of 3.1 million of barrels of oil equivalent a day, including 7.7 million cubic feet a day of natural gas and 1.8 million of barrels of liquids a day. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the US and Asia for total refining capacity of 1.8 million barrels of oil a day. Proven reserves at year-end 2023 stood at 11.1 billion barrels of oil equivalent, including 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas.

Having examined the options trading patterns of Chevron, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Chevron's Current Market Status

- Trading volume stands at 3,609,065, with CVX's price up by 0.32%, positioned at $166.42.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 88 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Chevron options trades with real-time alerts from Benzinga Pro.