Investors were disappointed with Hymson Laser Technology Group Co.,Ltd.'s (SHSE:688559) recent earnings. We think there is more to the story than simply soft profit numbers. Our analysis shows that there are some other factors of concern.

A Closer Look At Hymson Laser Technology GroupLtd's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

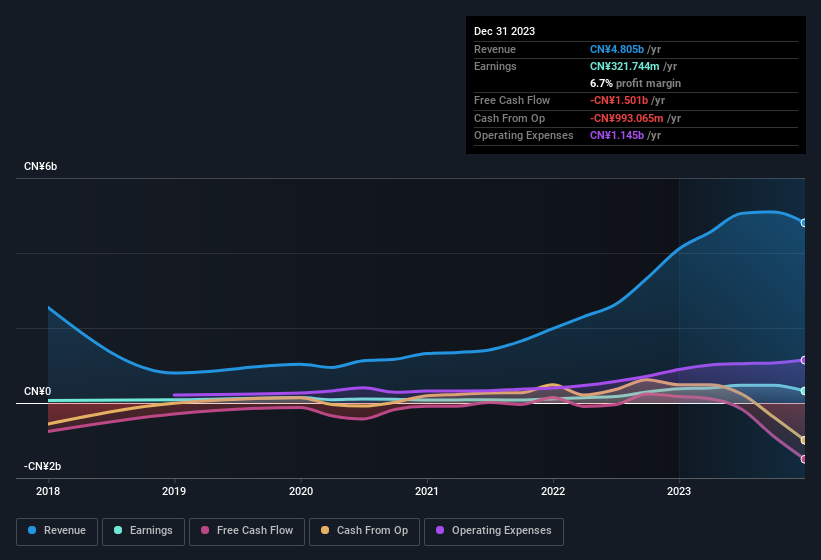

Hymson Laser Technology GroupLtd has an accrual ratio of 0.69 for the year to December 2023. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. In the last twelve months it actually had negative free cash flow, with an outflow of CN¥1.5b despite its profit of CN¥321.7m, mentioned above. It's worth noting that Hymson Laser Technology GroupLtd generated positive FCF of CN¥174m a year ago, so at least they've done it in the past. Having said that it seems that a recent tax benefit and some unusual items have impacted its profit (and this its accrual ratio).

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

The fact that the company had unusual items boosting profit by CN¥77m, in the last year, probably goes some way to explain why its accrual ratio was so weak. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. We can see that Hymson Laser Technology GroupLtd's positive unusual items were quite significant relative to its profit in the year to December 2023. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that Hymson Laser Technology GroupLtd received a tax benefit of CN¥28m. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. The receipt of a tax benefit is obviously a good thing, on its own. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Hymson Laser Technology GroupLtd's Profit Performance

In conclusion, Hymson Laser Technology GroupLtd's weak accrual ratio suggests its statutory earnings have been inflated by the non-cash tax benefit and the boost it received from unusual items. On reflection, the above-mentioned factors give us the strong impression that Hymson Laser Technology GroupLtd'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. While conducting our analysis, we found that Hymson Laser Technology GroupLtd has 2 warning signs and it would be unwise to ignore these.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.