Earnings Growth of 3.6% Over 3 Years Hasn't Been Enough to Translate Into Positive Returns for ORG TechnologyLtd (SZSE:002701) Shareholders

Earnings Growth of 3.6% Over 3 Years Hasn't Been Enough to Translate Into Positive Returns for ORG TechnologyLtd (SZSE:002701) Shareholders

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. In contrast individual stocks will provide a wide range of possible returns, and may fall short. Unfortunately, that's been the case for longer term ORG Technology Co.,Ltd. (SZSE:002701) shareholders, since the share price is down 25% in the last three years, less than the market decline of around 19%.

如今,簡單地購買指數基金很容易,而且您的回報應該(大致地)與市場相匹配。相比之下,個股將提供廣泛的可能回報,並且可能不足。不幸的是,從長遠來看,奧瑞金科技公司的情況就是這樣。, Ltd.(深圳證券交易所:002701)的股東,由於股價在過去三年中下跌了25%,低於市場19%左右的跌幅。

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

鑑於過去一週對股東來說很艱難,讓我們調查一下基本面,看看我們能學到什麼。

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

不可否認,市場有時是有效的,但價格並不總是能反映潛在的業務表現。研究市場情緒如何隨着時間的推移而變化的一種方法是研究公司股價與其每股收益(EPS)之間的相互作用。

Although the share price is down over three years, ORG TechnologyLtd actually managed to grow EPS by 11% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

儘管股價在三年內下跌,但ORG TechnologyLtd實際上設法在那段時間內每年將每股收益增長11%。這真是個難題,表明可能會有一些東西暫時提振股價。否則,該公司過去曾被過度炒作,因此其增長令人失望。

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

由於每股收益的變化似乎與股價的變化無關,因此值得一看其他指標。

Revenue is actually up 5.9% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating ORG TechnologyLtd further; while we may be missing something on this analysis, there might also be an opportunity.

在過去的三年中,收入實際上增長了5.9%,因此股價下跌似乎也不取決於收入。可能值得進一步研究ORG TechnologyLtd;儘管我們在分析中可能遺漏了一些東西,但也可能有機會。

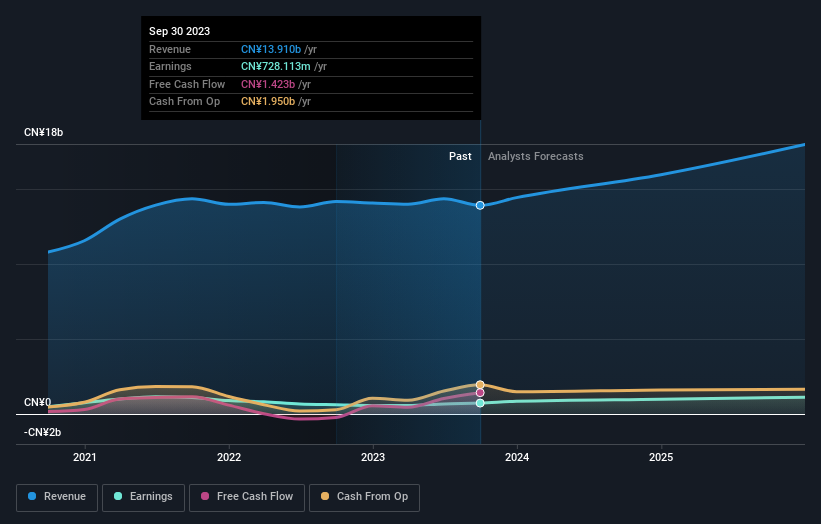

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

下圖描述了收入和收入隨時間推移而發生的變化(點擊圖片即可顯示確切的數值)。

We know that ORG TechnologyLtd has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for ORG TechnologyLtd in this interactive graph of future profit estimates.

我們知道ORG TechnologyLtd最近提高了利潤,但是未來會發生什麼?在這張未來利潤估計的交互式圖表中,您可以看到分析師對ORG TechnologyLtd的預測。

What About Dividends?

分紅呢?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of ORG TechnologyLtd, it has a TSR of -21% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

在考慮投資回報時,重要的是要考慮兩者之間的區別 股東總回報 (TSR) 和 股價回報。基於股息再投資的假設,股東總回報率納入了任何分拆或貼現資本籌集的價值以及任何股息。可以公平地說,股東總回報率爲支付股息的股票提供了更完整的畫面。就ORG科技有限公司而言,其在過去三年的股東回報率爲-21%。這超過了我們之前提到的其股價回報率。這在很大程度上是其股息支付的結果!

A Different Perspective

不同的視角

Although it hurts that ORG TechnologyLtd returned a loss of 4.3% in the last twelve months, the broader market was actually worse, returning a loss of 14%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 1.6% over the last half decade. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. It's always interesting to track share price performance over the longer term. But to understand ORG TechnologyLtd better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for ORG TechnologyLtd you should know about.

儘管ORG TechnologyLtd在過去十二個月中回報了4.3%的虧損令人痛心,但整個市場實際上更糟,虧損了14%。不幸的是,去年的表現可能預示着尚未解決的挑戰,因爲它比過去五年1.6%的年化虧損還要糟糕。儘管一些投資者在專門收購陷入困境(但仍被低估)的公司方面表現良好,但不要忘記巴菲特說過 “轉機很少會轉機”。長期跟蹤股價表現總是很有意思的。但是,爲了更好地了解ORG TechnologyLtd,我們需要考慮許多其他因素。例如,考慮風險。每家公司都有它們,我們發現了一個你應該知道的ORG TechnologyLTD警告標誌。

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

如果你像我一樣,那麼你不會想錯過這份業內人士正在收購的成長型公司的免費名單。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文引用的市場回報反映了目前在中國交易所交易的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。