Futures prices continue to reach new highs

Recently, the price of gold has continued to soar, and during the Ching Ming Festival holiday, it has continued to rise to a new high.

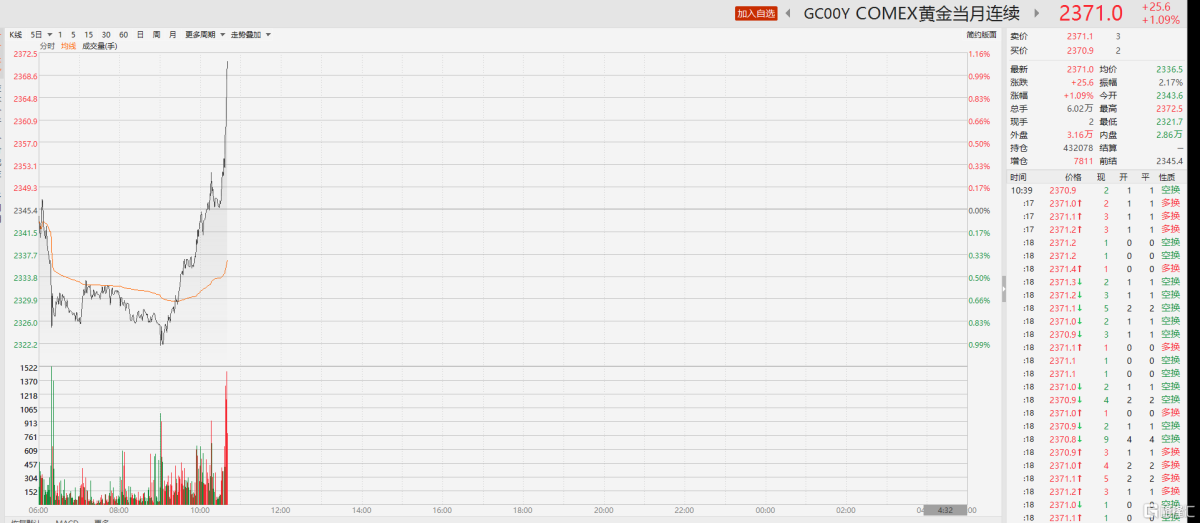

On April 8, spot gold rose by 16 US dollars in the short term, reaching a new high of 2343.5 US dollars/ounce; COMEX futures rose more than 1% during the day and are now reported at 2,371 US dollars/ounce.

Although the latest US employment report for March helped the US dollar find demand, gold and the US dollar continue to benefit from escalating geopolitical tension. Currently, gold remains above 2,300 US dollars.

In the Hong Kong A-share market, gold stocks also continued their recent gains. Among Hong Kong stocks, Shandong Gold rose 7.39%, Lingbao Gold rose more than 6%, and Zhaojin Mining and China Gold International rose more than 5%.

A-shares have 5 consecutive shares, Zhongrun Resources has 3 consecutive boards. Sichuan gold rose more than 8%, while Western Gold and Shandong Gold followed suit.

The central bank increased its gold reserves for 17 consecutive months

On April 7, data on the size of foreign exchange reserves released by the State Administration of Foreign Exchange showed that as of the end of March 2024, China's foreign exchange reserves were US$3245.7 billion, up 19.8 billion US dollars from the end of February, an increase of 0.62%.

Regarding changes in the size of foreign exchange reserves in March, the State Administration of Foreign Exchange pointed out that in March 2024, due to factors such as monetary policies and expectations and macroeconomic data of major economies, the US dollar index rose, and global financial asset prices generally rose. Due to a combination of factors such as exchange rate conversion and changes in asset prices, the size of foreign exchange reserves increased during the month.

Meanwhile, as of the end of March 2024, China's gold reserves were 72.74 million ounces. This is the 17th consecutive month since November 2022 that the central bank has increased its gold reserves.

Wang Qing, chief macro analyst at Dongfang Jincheng, analyzed that against the backdrop of increased fluctuations in US bond yields, the People's Bank of China continues to increase its gold holdings, which helps preserve and increase the value of reserve assets. Furthermore, it can also lay a solid foundation for continuing to advance the internationalization process of the RMB. The Central Financial Work Conference called for “steady and steady promotion of the internationalization of the RMB,” and this year's government work report clearly proposed “promoting the facilitation of cross-border trade investment and financing, the internationalization of the RMB, and the construction of international financial centers in an integrated manner.”It is still the general direction for the People's Bank of China to increase gold holdings in the later stages.

The pace of gold purchases by central banks around the world continues

It is worth mentioning that not only China's central bank, but central banks around the world are “hoarding” gold.

On January 31, the “Global Gold Demand Trend Report” released by the World Gold Council showed that in 2023, global central banks purchased 1,037 tons of gold, the second highest in history, a decrease of only 45 tons compared to 2022.

Furthermore, as of the end of March 2024, the top ten global gold reserves (the United States, Germany, Italy, France, Russia, China, Switzerland, Japan, India, and the Netherlands) had gold reserves of 24260.63 tons, up 15.58 tons from February, and also for 17 consecutive months.

According to a report released by Swiss Customs, Switzerland delivered a total of 89 tons of gold to China in February, compared to 12 tons in the same period last year. Since January 2023, Switzerland has delivered 762 tons of gold to China, an increase of 21% over last year. According to statistics published by the World Gold Council and Swiss Customs, at least 2,599 tons of gold have arrived in China from the three major international gold markets of the United States, the United Kingdom, and Switzerland since November 2022.At this moment, gold is a strategic reserve requirement for the country, not a simple asset allocation.

Wang Lixin of the World Gold Council said that based on global central bank purchases reaching a record high in 2022, the market previously anticipated that global central banks would continue to increase their gold reserves in 2023, but the scale of the increase may not reach the 2022 level, but the global central bank's gold purchase scale still reached 1,037 tons in 2023, which certainly surprised the market. This shows that central banks around the world have re-recognized the reserve role of gold in the process of diversifying the allocation of foreign exchange reserve assets.

More importantly, the increase in gold reserves by central banks around the world is not based on short-term profit purposes, but rather a consideration of the strategic allocation of foreign exchange reserve assets. Once the country's central bank formulates a new foreign exchange reserve asset allocation policy, it will continue for some time.

Looking ahead, a continued rebound in gold prices may trigger further investment flows. However, the Fed's stronger stance may cause resistance to gold in the short term. Furthermore, the rapid fluctuation in the price of gold often discourages jewellery consumers. The famous American economist David Rosenberg also believes that the rise in gold is not over and is expected to rise to 3,000 US dollars before the next business cycle changes, which is a 30% increase compared to the current price.

Tianfeng Securities said that gold stands at the starting point of a medium- to long-term bull market, and the elasticity of gold stocks is about 2.23 times that of gold prices. Guojin Securities believes that it is expected that the Federal Reserve will release an “easing signal” in Q2, which will be the starting point for a boom in gold stocks. Furthermore, according to the Daily Economic News, many private equity firms believe that multiple benefits resonate, the metal properties of resource products are being activated, and consumption of non-colored products is expected to drive the bullish trend of commodities and start a wave of “periodic table of elements”. It is expected to drive commodities to bullish and start a wave of “periodic table of elements” markets.