The top three net purchases on the Dragon Tiger list today are Hi-Tech Development, Jingda Co., Ltd., and Kangda New Materials

Today, A-shares collectively closed down. More than 4,500 shares in the two markets fell, trading 1.04 trillion yuan throughout the day, breaking through trillion yuan for the 6th day in a row, with net purchases of 5.571 billion yuan from Beijing Capital.

AI application concept stocks, which were popular in the early days, generally declined. Kimi's concept cooled down, and copper high-speed connection concept stocks declined; petroleum stocks strengthened, and a few sectors such as the Xiaomi car sector, banks, precious metals, and shale gas rose.

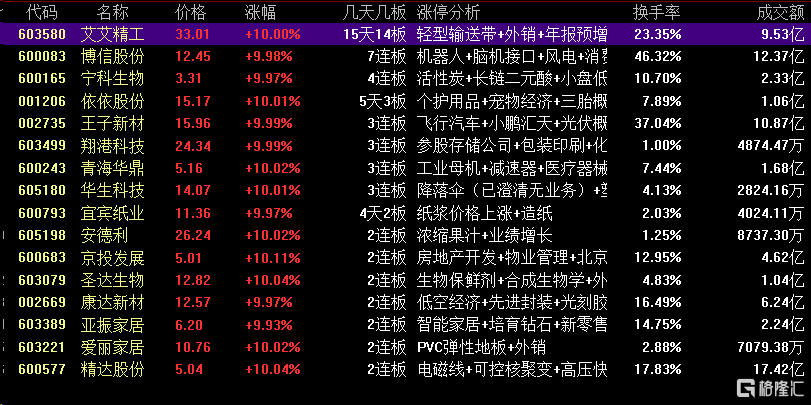

In terms of high-ranking stocks, the machinery and equipment stock Ai Precision is based on the 15-day 14 board, the consumer electronics sector, the 7th board of Yingtong Communications, the 6-day 3 board, the chemical company Ningke Biotech 4 board, the chip industry chain's Xianggang Technology 3 board, Jingda New Materials 2 board, the low-altitude economy concept stock Prince New Materials 3 board, the industrial mother machine sector, Qinghai Huading 3 board, and the pet economy concept stock is based on the 5-day 3 board of pet economy shares.

Let's take a look at today's Dragon Tiger rankings:

Today, the top three net purchases on the Dragon Tiger list were Hi-Tech Development, Jingda Co., Ltd., and Kangda New Materials, which were 468 million yuan, 296 million yuan, and 905.53 million yuan respectively.

The top three net sales on the Dragon Tiger list were Boxin Co., Ltd., Zhongyuan Media, and Zhangyue Technology, which were 133 million yuan, 132 million yuan, and 986.13,500 yuan respectively.

Among the individual stocks involved in exclusive institutional seats in the Dragon Tiger list, the top three were Jingda Shares, Hi-Tech Development, and Haijian Shares in the same day, which were 322 million yuan, 242 million yuan, and 476.12,200 yuan respectively.

Among the individual stocks involved in exclusive institutional seats in the Dragon Tiger list, the top three in net sales for the day were Palm Reading Technology, Onli Education, and Shengtian Network, which were 142 million yuan, 97.3716 million yuan, and 41.32 million yuan respectively.

The subject of some of the individual stocks on the list:

High-tech development (domestic computing power)

Orient Securities released a research report saying that with the popularity of the big model led by Kimi, the number of visits, etc. continues to rise, it is imperative for various companies to expand their reasoning power. Also, as the length of the context of long texts increases, the consumption of computing power will surely increase. With the continuous iterative upgrading of large models such as Kimi, the number of model parameters and the amount of training data are expected to continue to increase, and the scaling law will continue to work to drive computing power demand. Domestic AI chip manufacturers, domestic AI chip line and Nvidia line server manufacturers, computing power service providers such as computing power leasing, IDC, and server operation and maintenance are all expected to continue to benefit.

Jingda Co., Ltd. (high-speed wire+superconductive+flat wire+special electromagnetic wire)

1. High-speed lines produced by the subsidiary Hengfeng Special Guidance are mainly used in high-speed information transmission fields such as data centers and 5G signal base stations.

2. The company is the largest shareholder of superconductivity in Shanghai. It is mainly engaged in the production, R&D and sales business of special electromagnetic wires, special conductors, and mold manufacturing and maintenance. The products are mainly used in the fields of automobiles, electricity, motors, photovoltaics, etc. The products are mainly divided into three series: one is a copper-based electromagnetic wire series, the second is an aluminum-based electromagnetic wire series, and the third is a special conductor series.

3. The company is an important supplier for BYD. Some flat wire products are used in the field of electric trucks and robot servo motors.

4. Some of the company's products are used in rare earth-free motors. On March 19, 2024, it was announced that total revenue for 2023 was 17.906 billion yuan, up 2.07% year on year, and net profit to mother was 426 million yuan, up 11.84% year on year.

Boxin Co., Ltd. (robot+artificial intelligence+brain-computer interface)

1. The change was announced on March 22, 2024. The company belongs to a traditional, non-high-tech industry and does not involve hot market concepts such as artificial intelligence.

2. The intelligent sweeping robot is a sales product of the company's intelligent hardware and derivatives business. The company interacted that the main source of revenue from the smart hardware proprietary product business is sales of sweepers, air purifiers, and bladeless fans.

3. The company mainly engages in comprehensive equipment services and intelligent hardware and derivative products. The company set up an artificial intelligence laboratory and initially reached scientific research cooperation intentions in the fields of audio analysis, machine vision, motion analysis, brain-computer interaction, etc., and is committed to the commercial transformation of artificial intelligence research results to create more AI-enabled products and services.

4. The company's artificial intelligence laboratory TLab.ai cooperated deeply with Brainco, the world's top brain-computer interface technology company, to develop educational and health products based on deep learning and EEG analysis technology. On March 7, 2024, Interactive did not cooperate with Brain Strong Technology.

5. The company relies on the TOPPERS brand, with artificial intelligence and big data technology as the core. The products include smart speakers, smart headphones, smart watches, etc., and the actual controller is the Suzhou Gusu District State-owned Assets Administration Office.

Institutions focus on trading individual stocks:

Jingda Co., Ltd.:It rose and stopped for 2 consecutive days. By the close, it was 5.04 yuan/share, with a turnover of 1,742 billion yuan and a total market value of 10.479 billion yuan. According to data from the Dragon Tiger List, 2 institutions bought 386 million yuan, 1 agency sold 64.52 million yuan, the total net purchase of the agency was 322 million yuan, and the total net sales of northbound capital were 9.5841 million yuan. Famous tourist destinations such as Pearl Road in Yichang, the national government are famous.

High-tech development:Today's increase was 1.18%, the daily turnover rate was 30.14%, and the turnover was 5.158 billion yuan, or 7.99%. According to Dragon Tiger Index data, 2 institutions bought 347 million yuan, 1 agency sold 105 million yuan, net institutional purchases of 242 million yuan, and Shenzhen Stock Connect made a net purchase of 579.17,200 yuan. The total net purchase of sales department seats was 168 million yuan.

Haidian shares:Today, it fell 2.27% to 32.23 yuan, with a turnover rate of 39.43%, a turnover of 164,400 lots, and a turnover of 565 million yuan. According to data from the Dragon Tiger List, the total net purchase of the institution was 476.12,200 yuan, and the total net sales of northbound capital were 1,553,700 yuan. Famous tourist investors such as Little Padded Jacket are famous.

Palm Reading Technology:Today's decline was 5.97%, with a turnover rate of 23.81%. The volume was 1.044,800 lots, and the turnover was 3.447 billion yuan. According to data from the Dragon Tiger List, the total net sales of the two institutions were 142 million yuan, and the total net sales of Northbound capital were 6.417,700 yuan. Famous tourist destinations such as Sangtian Road in Ningbo are famous.

Onli Education:Today's decline was 11.14 yuan, with a turnover rate of 7.11%, a turnover of 203,900 lots, and a turnover of 236 million yuan. According to data from the Dragon Tiger List, the total net sales of the four institutions were 97.3716 million yuan.

Shengtian Network:Today, it rose 6.46% to close at 17.63 yuan, with a turnover rate of 39.69%, a turnover of 1,586,300 hands, and a turnover of 2.98 billion yuan. According to data from the Dragon Tiger List, the total net sales of the two institutions were 41.232 million yuan, and the total net purchase of Northbound capital was 19.019,500 yuan. Famous tourist investors such as Little Crocodile are famous on the tourist list.

In the Dragon Tiger list, there are 5 individual stocks involving the Shanghai Stock Connect exclusive seat. Dynamic Technology's Shanghai Stock Connect exclusive seat had the largest net purchase amount, with a net purchase of 2,411 million yuan.

In the Dragon Tiger list, there are 7 individual stocks involving exclusive seats on Shenzhen Stock Connect. Hi-Tech Development's Shenzhen Stock Connect exclusive seat had the largest net purchase amount, with a net purchase of 579.17,200 yuan.

Trends in volatile capital operations:

Tu Wenbin:Net purchase of Hi-Tech Development RMB 208.6 million

Fang Xinxia:Net purchase of Shangluo Electronics 68.36 million yuan

Low-level excavation:Net purchases of Yuneng Holdings and Kangda New Materials were 26.85 million yuan and 14.75 million yuan respectively

Tohoku Takeo:Net purchases of Shengtian Network and Shengjingwei were 22.6152 million yuan and 16.7847 million yuan respectively, and net sales of Dinglong Technology were 15.385 million yuan

Shandong gang:Net purchase of Kangda New Materials was 247.388 million yuan

Chengdu gang:Net sales of Power Xinke 15.5097 million yuan

Brother Shennan:Net sale of Shangluo Electronics 18.303 million yuan