Today, February 19, 2024, marks an important moment for investors of First Interstate BancSys (NASDAQ:FIBK). The company will distribute a dividend payout of $0.47 per share, demonstrating an annualized dividend yield of 6.60%. Remember, only shareholders prior to the ex-dividend date on February 08, 2024 are eligible for this payout.

First Interstate BancSys Recent Dividend Payouts

| Ex-Date | Payments per year | Dividend | Yield | Announced | Record | Payable |

|---|

| 2024-02-08 | 4$0.47 | | 6.6% | 2024-01-26 | 2024-02-09 | 2024-02-19 |

| 2023-11-03 | 4$0.47 | | 8.45% | 2023-10-24 | 2023-11-06 | 2023-11-16 |

| 2023-08-04 | 4$0.47 | | 6.9% | 2023-07-25 | 2023-08-07 | 2023-08-17 |

| 2023-05-05 | 4$0.47 | | 6.81% | 2023-04-25 | 2023-05-08 | 2023-05-18 |

| 2023-02-06 | 4$0.47 | | 5.05% | 2023-01-25 | 2023-02-07 | 2023-02-17 |

| 2022-11-07 | 4$0.47 | | 4.46% | 2022-10-24 | 2022-11-08 | 2022-11-18 |

| 2022-08-08 | 4$0.41 | | 4.15% | 2022-07-25 | 2022-08-09 | 2022-08-19 |

| 2022-05-09 | 4$0.41 | | 4.92% | 2022-04-27 | 2022-05-10 | 2022-05-20 |

| 2022-02-09 | 4$0.41 | | 4.13% | 2022-01-26 | 2022-02-10 | 2022-02-21 |

| 2021-11-05 | 4$0.41 | | 3.88% | 2021-10-25 | 2021-11-08 | 2021-11-18 |

| 2021-08-06 | 4$0.41 | | 3.93% | 2021-07-26 | 2021-08-09 | 2021-08-19 |

| 2021-05-10 | 4$0.41 | | 3.37% | 2021-04-26 | 2021-05-11 | 2021-05-21 |

First Interstate BancSys's dividend yield falls in the middle range when compared to its industry peers, with TFS Financial (NASDAQ:TFSL) having the highest annualized dividend yield at 8.45%.

Analyzing First Interstate BancSys Financial Health

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

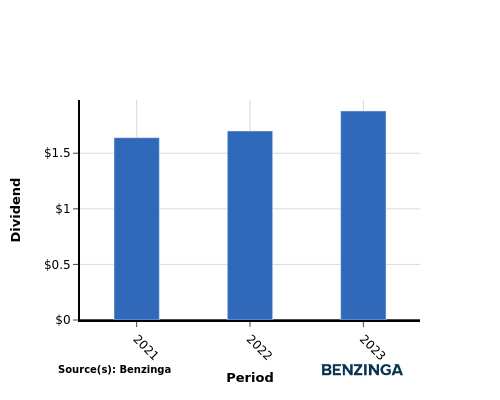

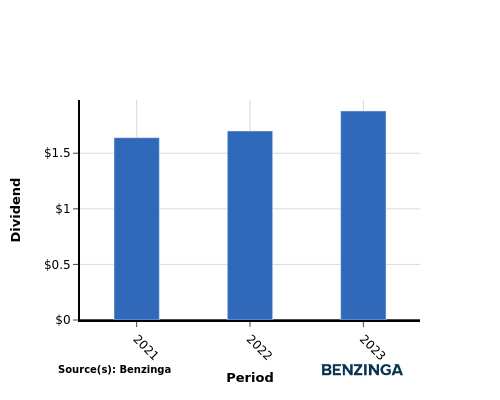

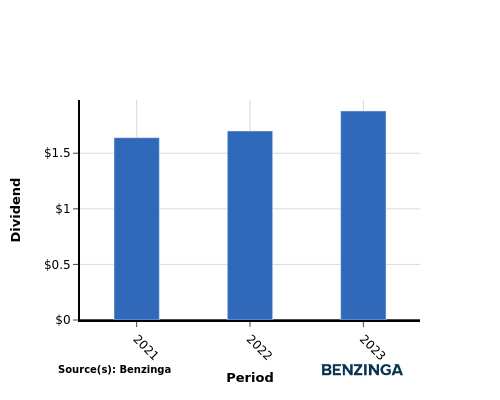

YoY Growth in Dividend Per Share

During the period of 2021 to 2023, the company experienced a notable growth in its dividend per share. The dividend per share increased from $1.64 to $1.88, reflecting the company's focus on providing greater returns to its shareholders.

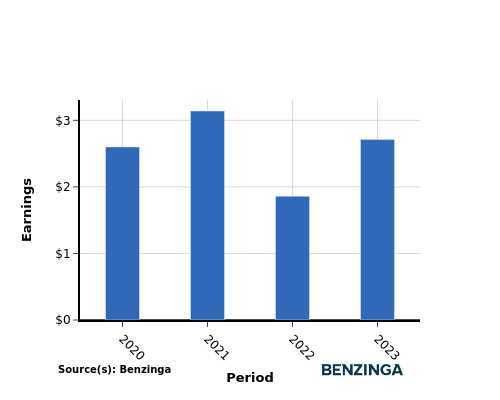

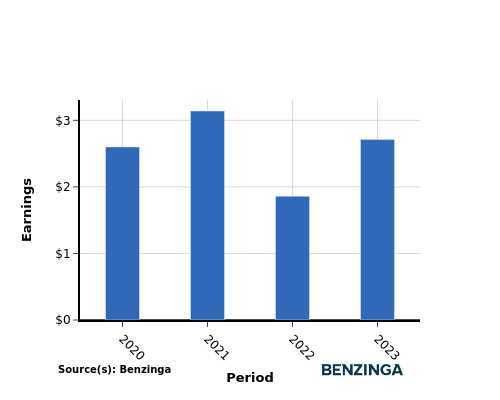

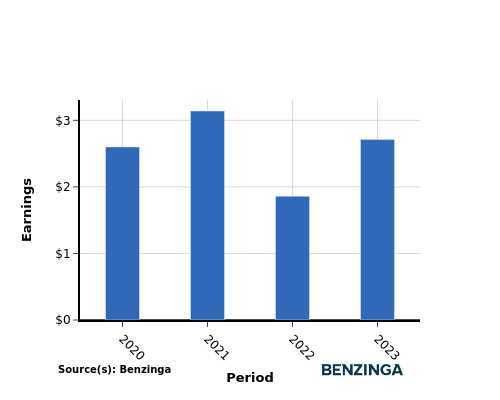

YoY Earnings Growth For First Interstate BancSys

The earnings chart above shows that from 2021 to 2023, First Interstate BancSys has experienced an increase in their earnings from $2.60 per share to $2.71 per share. This positive earnings trend is promising for income-seeking investors as it suggests that the company has more potential to increase its cash dividend payout if the trend continues.

Recap

In this article, we explore the recent dividend payout of First Interstate BancSys and its significance for shareholders. The company has decided to distribute a dividend of $0.47 per share today, which equates to an annualized dividend yield of 6.60%.

First Interstate BancSys's dividend yield falls in the middle range when compared to its industry peers, with TFS Financial having the highest annualized dividend yield at 8.45%.

The upward trend in dividend per share and earnings per share for First Interstate BancSys from 2021 to 2023 reflects a strong financial position, supporting the company's ability to consistently distribute profits to their investors.

To stay well-informed about potential changes in financials or dividend disbursements, investors should closely observe the company's performance in the upcoming quarters.

[Monitor live stock price updates for First Interstate BancSys on Benzinga.](First Interstate BancSys (NASDAQ: FIBK))

This article was generated by Benzinga's automated content engine and reviewed by an editor.

2024年2月19日は、First Interstate BancSys(NASDAQ:FIBK)の投資家にとって重要な時点です。同社は、株式ごとに0.47ドルの配当金を支払い、年間配当利回りは6.60%を示します。配当落ち日である2024年2月8日より前に株主になっている人だけが、この配当金の対象となります。First Interstate BancSysの最近の配当金支払い配当落ち日のレコード日 :2024年2月8日

年間支払回数 :4

配当 :0.47

配当利回り :6.60%

発表日 :2024年1月26日

レコード日 :2024年2月9日

支払日 :2024年2月19日

2024-02-08 4 0.47 6.60% 2024-01-26 2024-02-09 2024-02-19

2023-11-03 4 0.47 6.42% 2023-10-24 2023-11-06

| 配当落し日 | 支払回数 | 配当 | 配当利回り | 発表日 | レコード日 | 支払日 |

|---|

| 2024-02-08 | 4$0.47 | | 6.6% | 2024-01-26 | 2024-02-09 | 2024-02-19 |

| 2023-11-03 | 4$0.47 | | 8.45% | 2023-10-24 | 2023-11-06 | 2023年11月16日 |

| 2023年08月04日 | 4$0.47 | | 6.9% | 2023年07月25日 | 2023年08月07日 | 2023年08月17日 |

| 2023年05月05日 | 4$0.47 | | 6.81% | 2023年04月25日 | 2023年05月08日 | 2023年05月18日 |

| 2023年02月06日 | 4$0.47 | | 5.05% | 2023年01月25日 | 2023年02月07日 | 2023年02月17日 |

| 2022年11月07日 | 4$0.47 | | 4.46% | 2022年10月24日 | 2022年11月08日 | 2022年11月18日 |

| 2022年08月08日 | 4ドル41セント | | 4.15% | 2022年07月25日 | 2022年08月09日 | 2022年08月19日 |

| 2022年05月09日 | 4ドル41セント | | 4.92% | 2022年04月27日 | 2022年05月10日 | 2022年05月20日 |

| 2022年02月09日 | 4ドル41セント | | 4.13% | 2022年01月26日 | 2022年02月10日 | 2022年02月21日 |

| 2021年11月05日 | 4ドル41セント | | 3.88% | 2021年10月25日 | 2021年11月08日 | 2021年11月18日 |

| 2021年08月06日 | 4 $ 0.41 | | 3.93% | 2021年07月26日 | 2021年08月09日 | 2021年08月19日 |

| 2021年05月10日 | 4 $ 0.41 | | 3.37% | 2021年04月26日 | 2021年05月11日 | 2021年05月21日 |

ファーストインターステートバンクシステムズの配当利回りは、業界の同僚と比較すると中程度の範囲内にある。tfsファイナンシャル(NASDAQ:TFSL)年間配当利回り8.45%で最も高い

ファーストインターステートバンクシスの財務健全性の分析

安定的なキャッシュ配当を支払う企業は、所得を求める投資家にとって魅力的であり、財務的に健全な企業は通常、配当支払いスケジュールを維持します。このため、投資家は、企業が配当支払いスケジュールを増減させているか、およびその収益が成長しているかどうかを調べることが有益であると考えることができます。

1株あたり配当金の年間成長率

2021年から2023年の期間中、会社は1株あたり配当金に注目すべき著しい成長を示しました。1株あたり配当金は、1.64ドルから1.88ドルに増加し、株主により大きなリターンを提供することに焦点を当てていることを反映しています。

2021年から2023年の期間中、会社は1株あたり配当金に注目すべき著しい成長を示しました。1株あたり配当金は、1.64ドルから1.88ドルに増加し、株主により大きなリターンを提供することに焦点を当てていることを反映しています。

ファーストインターステートバンクシスの1株あたり収益成長率

上記の収益チャートは、2021年から2023年にかけて、ファーストインターステートバンクシスが1株あたり収益を2.60ドルから2.71ドルに増加させたことを示しています。このプラスの収益トレンドは、配当所得を求める投資家にとって有望であり、同様のトレンドが続けば、企業がキャッシュ配当を増やす可能性が高いと示唆しています。

まとめ

この記事では、First Interstate BancSysの最近の配当支払いと株主にとっての重要性について探究します。同社は、本日1株あたり0.47ドルの配当金を配当することを決定しました。これは、年換算の配当利回り6.60%に相当します。

First Interstate BancSysの配当利回りは、業界の同僚と比較して中程度に位置しており、TFS Financialが年換算配当利回り8.45%で最も高いです。

2021年から2023年にかけてのFirst Interstate BancSysの1株あたり配当金および1株あたり利益の上向き傾向は、財務的に強い立場を反映しており、同社の投資家に利益を一貫して配分する能力を支持しています。

財務面や配当支払いの潜在的な変更についてよく知るためには、投資家は今後の四半期における同社の業績を注意深く観察する必要があります。

[Benzingaのライブ株価更新をフォローする](First Interstate BancSys(NASDAQ:FIBK))

この記事はBenzingaの自動コンテンツエンジンによって生成され、編集者によってレビューされました。

2021年から2023年の期間中、会社は1株あたり配当金に注目すべき著しい成長を示しました。1株あたり配当金は、1.64ドルから1.88ドルに増加し、株主により大きなリターンを提供することに焦点を当てていることを反映しています。

2021年から2023年の期間中、会社は1株あたり配当金に注目すべき著しい成長を示しました。1株あたり配当金は、1.64ドルから1.88ドルに増加し、株主により大きなリターンを提供することに焦点を当てていることを反映しています。