The top three net purchases on the Dragon Tiger list are Eston, Zhongke Magnetic, and Sinochem International

On February 7, the market continued to rebound. All major indices were in the red, but the micro market index plummeted 9%.

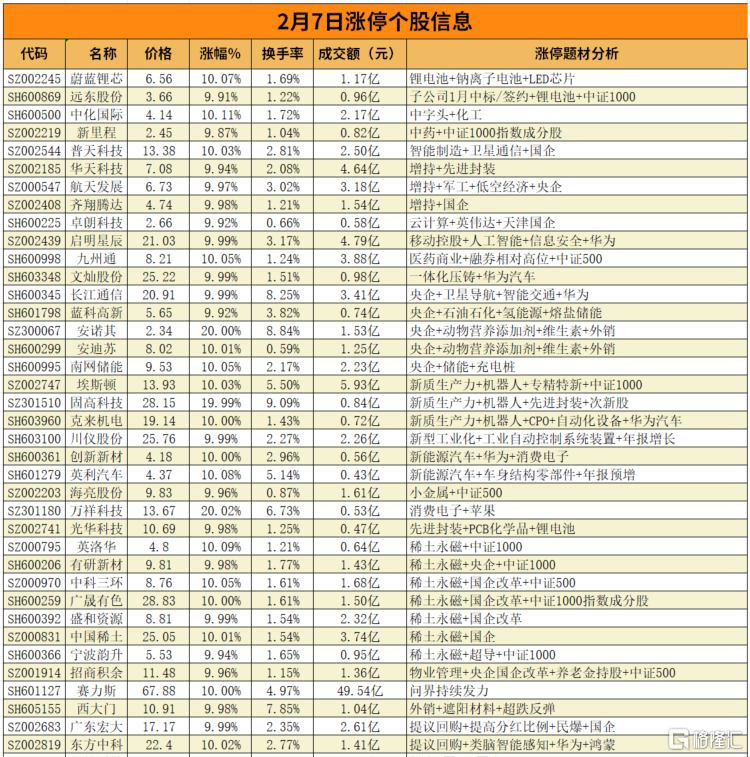

More than 3,000 stocks in the two markets fell, more than 2,200 stocks rose, 282 stocks fell to a halt, and 100 stocks rose and stopped. Market hot spots focused on sectors such as pharmaceuticals, home appliances, automobiles, and rare earths.

In terms of high-ranking stocks, the new quality productivity is a 5-day 4-board, a 5-day 4-board for Hasson Corporation, a 3-day Yongchuang Smart 2-board, a satellite navigation Changjiang Communications 3-connected board, a photovoltaic concept Hongtao Co., Ltd. 3-connected board, a rare earth concept, Guangsheng Nonferrous, Zhongke Tri-Ring, Shenghe Resources 2-connected board, diet drug Pro-Pharmaceuticals 2-connected board, and Celis 2-connected board.

Let's take a look at today's Dragon Tiger rankings:

The top three net purchases on the Dragon Tiger list today were Eston, Zhongke Magnetic, and Sinochem International, which were 61.3742 million yuan, 44.8261 million yuan, and 447.066 million yuan respectively.

The top three net sales figures on the Dragon Tiger list were Zhongji Health, Yinbaoshan Xinxin, and Yidao Information, which were 34.815 million yuan, 338.229 million yuan, and 31.7812 million yuan respectively.

Among the individual stocks involved in dedicated institutional seats in the Dragon Tiger list, the top three were Meijin Energy, Electric Network Security, and Baitong Energy in the same day, which were 52.9674 million yuan, 23.4521 million yuan, and 20.7525 million yuan respectively.

Among the individual stocks involved in exclusive institutional seats in the Dragon Tiger list, the top three were Kai Ming Chen, Yidao Information, and Far Sheng, which were 568.941 million yuan, 32.02 million yuan, and 21.9247 million yuan respectively.

The subject of some of the individual stocks on the list:

Eston (robot+new productivity+China Securities 1000)

It was popular for two consecutive days, and the first board rose and stopped. Shenzhen Stock Connect made a net purchase of 73.6973 million shares, 2 institutions made a net purchase of 23.344 million yuan, and 2 institutions made a net sale of 385.813 million yuan.

1. The company focuses on R&D, production and sales of high-end intelligent machinery and equipment and its core control and functional components. The main products include core automation components and motion control systems, industrial robots and intelligent manufacturing systems. The company has been selected by the Ministry of Industry and Information Technology's list of national specialized and innovative small giant enterprises.

2. According to the investor relations activity record table, in 2024, the company's industrial robots will continue to expand their markets in the fields of new energy, metal processing, building materials, furniture, etc., and welding, while also focusing on traditional industries and consumer electronics industries where demand for automobiles and automation is increasing.

Zhongke Magnetic (sub-IPO+rare earth permanent magnets)

The first board went up and down. Chengdu had a net purchase of 19865,900 yuan, a net purchase of 7.064 million yuan in quantitative trading, and a net sale of 5.889,500 yuan for institutions.

1. Mainly engaged in R&D, production and sales of permanent magnet materials, it is currently one of the important manufacturers of permanent magnet materials in China.

2. On February 6, the Ministry of Industry and Information Technology and the Ministry of Natural Resources issued the first batch of rare earth mining, smelting and separation total control indicators for 2024. The total control indicators for the first batch of rare earth mining, smelting and separation were 135,000 tons and 127,000 tons respectively, up 12.5% and 10.4%, respectively.

3. In the first three quarters of 2023, Zhongke Magnetic's revenue was 373 million yuan, down 25.89% year on year, and net profit attributable to shareholders of listed companies was 38.118 million yuan, down 51.03% year on year.

Medium Health (Chinese initial+agriculture)

Previously, it went up and down for 5 consecutive days. Today, the sky flooded, and there was a rapid decline in the intraday. Well-known Tour Investment Hong Kong and Guangdong had a net sale of 8.1826 million yuan, Gubei Road had a net sale of 178.474 million yuan, Shandong Bangjing had a net purchase of 114.655 million yuan, and a net purchase of 9.295 million yuan from quantitative funds.

1. The company is a national key leading agricultural industrialization enterprise with tomato products as its main business, integrating tomato cultivation, production, processing, trade, scientific research and development.

2. It is expected to achieve net profit of 80 million yuan to 110 million yuan in 2023, with a year-on-year change range of 206.69% to 321.70%.

Institutions focus on trading individual stocks:

Sinochem International:It rose and stopped, with a turnover rate of 1.72% and a turnover of 217 million yuan. The net purchase of quantitative funds was 11.388,500 yuan, the net purchase of overseas institutions was 8.4044 million yuan, and the net sale of Shanghai Stock Connect was 2.7068 million yuan.

Meijin Energy:It rose and stopped, with a turnover rate of 2.96% and a turnover of 660 million yuan. The net purchase of Shenzhen Stock Connect was 1,555,600 yuan, the net purchase of the four institutions was 52.9674 million yuan, and the net purchase of quantitative funds was 13.662 million yuan.

Electrical network security:It went up and down for 2 consecutive days, with a turnover rate of 3.25% and a turnover of 473 million yuan. The total net purchase of the institution was 234.521 million yuan, the total net sale of Northbound capital was 3.3312 million yuan, and the net purchase of quantitative funds was 10.4026 million yuan.

Kickstart Day:It went up and down for 2 consecutive days, with a turnover rate of 3.17% and a turnover of 479 million yuan. The total net sales of the institution was 568.941 million yuan, and the total net purchase of Northbound Capital was 37.88 million yuan.

In the Dragon Tiger list, the Shanghai Stock Connect exclusive seat made by Huada Zhizao had the largest net sales, with a net sale of 32.8 million yuan.

In the Dragon Tiger list, Eston's Shenzhen Stock Connect exclusive seat had the largest net purchase amount, with a net purchase of 73.69 million yuan.

Trends in volatile capital operations:

Northeast Fierce Men: Net purchases of Dinglong Technology for 8.69 million yuan, Everbright Garbao for 7.38 million yuan, Beizi Technology for 5.85 million yuan, net sales of Colida for 3.43 million yuan and Seodaemun for 3.4 million yuan

Stock trading to support the family: net purchases of Yingli Motor Company of 9.16 million yuan, Nord shares of 4.7 million yuan

Wenzhou Bang: Net sales of Funeng Technology for 6.16 million yuan, Western Magnetic Technology for 2.39 million yuan, Jiuling Technology for 4.26 million yuan, and Zhongke Magnetic for 3.04 million yuan

Shanghai Ultrashort: Net purchase of Kai Star Chen RMB 23.13 million

Huzhou Labor Road: net purchase of Yongchuang Smart for 5.88 million yuan

Southern Jiangsu: Net sales of innovative science and technology materials for 7.27 million yuan and Juncheng Technology for 5.2 million yuan